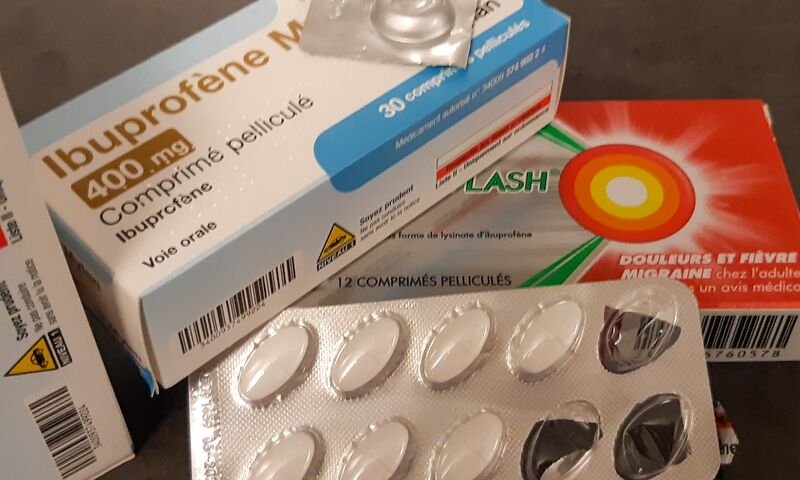

Coronavirus : les médecins alertent sur la prise d'anti-inflammatoires | Coronavirus et anti-inflammatoires de type ibuprofène ou cortisone : attention à ne pas faire n'importe quoi. Notre reportage. | By TF1 INFO

Santé : alerte sur ces anti-inflammatoires qui peuvent provoquer des complications graves | TF1 INFO

Ibuprofène et kétoprofène - Ne pas prendre d'anti-inflammatoires en cas d'infection - Actualité - UFC-Que Choisir