![Venus + Satin Care Pour La Peau Et Les Poils Pubiens, 1 Manche De Rasoir, 2 Recharges De Lames + Gel À Raser + Exfoliant + S[J76] - Cdiscount Electroménager Venus + Satin Care Pour La Peau Et Les Poils Pubiens, 1 Manche De Rasoir, 2 Recharges De Lames + Gel À Raser + Exfoliant + S[J76] - Cdiscount Electroménager](https://www.cdiscount.com/pdt2/5/9/6/1/700x700/tra1702771429596/rw/venus-satin-care-pour-la-peau-et-les-poils-pubie.jpg)

Venus + Satin Care Pour La Peau Et Les Poils Pubiens, 1 Manche De Rasoir, 2 Recharges De Lames + Gel À Raser + Exfoliant + S[J76] - Cdiscount Electroménager

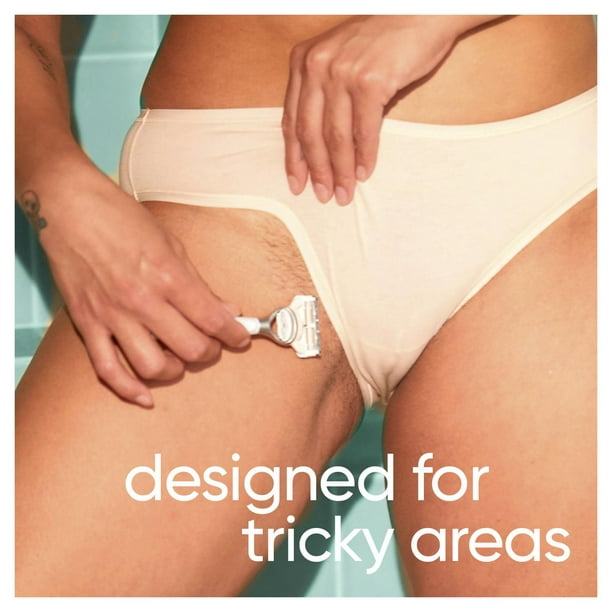

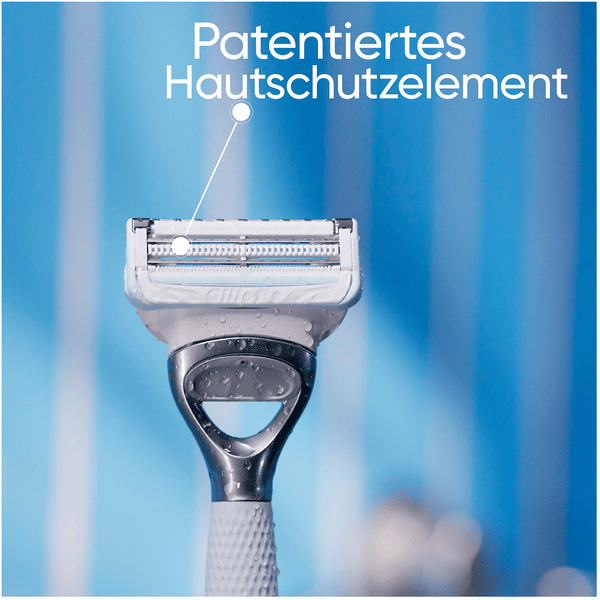

Beauté & Bien-être - Vénus Gillette + Satin Care - La première gamme de rasage pour la peau et les poils pubiens

![Venus + Satin Care Pour La Peau Et Les Poils Pubiens, 1 Manche De Rasoir, 2 Recharges De Lames + Gel À Raser + Exfoliant + S[J76] - Cdiscount Electroménager Venus + Satin Care Pour La Peau Et Les Poils Pubiens, 1 Manche De Rasoir, 2 Recharges De Lames + Gel À Raser + Exfoliant + S[J76] - Cdiscount Electroménager](https://www.cdiscount.com/pdt2/5/9/6/4/700x700/tra1702771429596/rw/venus-satin-care-pour-la-peau-et-les-poils-pubie.jpg)

Venus + Satin Care Pour La Peau Et Les Poils Pubiens, 1 Manche De Rasoir, 2 Recharges De Lames + Gel À Raser + Exfoliant + S[J76] - Cdiscount Electroménager

Gillette Venus Pour La Peau Et Les Poils Pubiens, Rasoir Pour Femme - 2 Lames, Aide À Protéger La Zone Sensible Du Maillot Du Feu Du Rasoir : Amazon.fr: Hygiène et Santé

Anti-crise.fr | Rasoir Venus Satin care chez Leclerc (09/05 – 20/05)Rasoir Venus Satin care chez Leclerc (09/05 - 20/05) - Catalogues Promos & Bons Plans, ECONOMISEZ ! - Anti-crise.fr