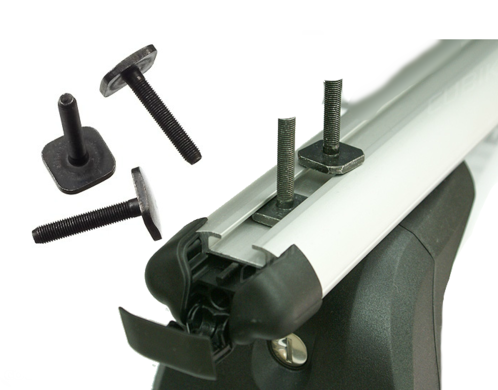

Amazon.fr : THULE - 697600 T-Track Adapter 697-6 Adapte Directement Le Coffre de Toit dans Le T-Track de la Barre de Toit (20mm for PowerClick G2/G3).

THULE T-TRACK ADAPTATEUR Cintre Sur Vis Moleté 20/24mm Profil Pour Libre Choix EUR 34,83 - PicClick FR