Honeywell Voyager 1200g Lecteur de Code Barre Portable 1D Laser Noir : Amazon.fr: Fournitures de bureau

Honeywell Voyager 1202g : douchette laser 1D Bluetooth multi-interface (USB, RS232, KBW). Version sans-fil du Voyager 1200g - Lecteur-Code-Barre.com par Idenweb

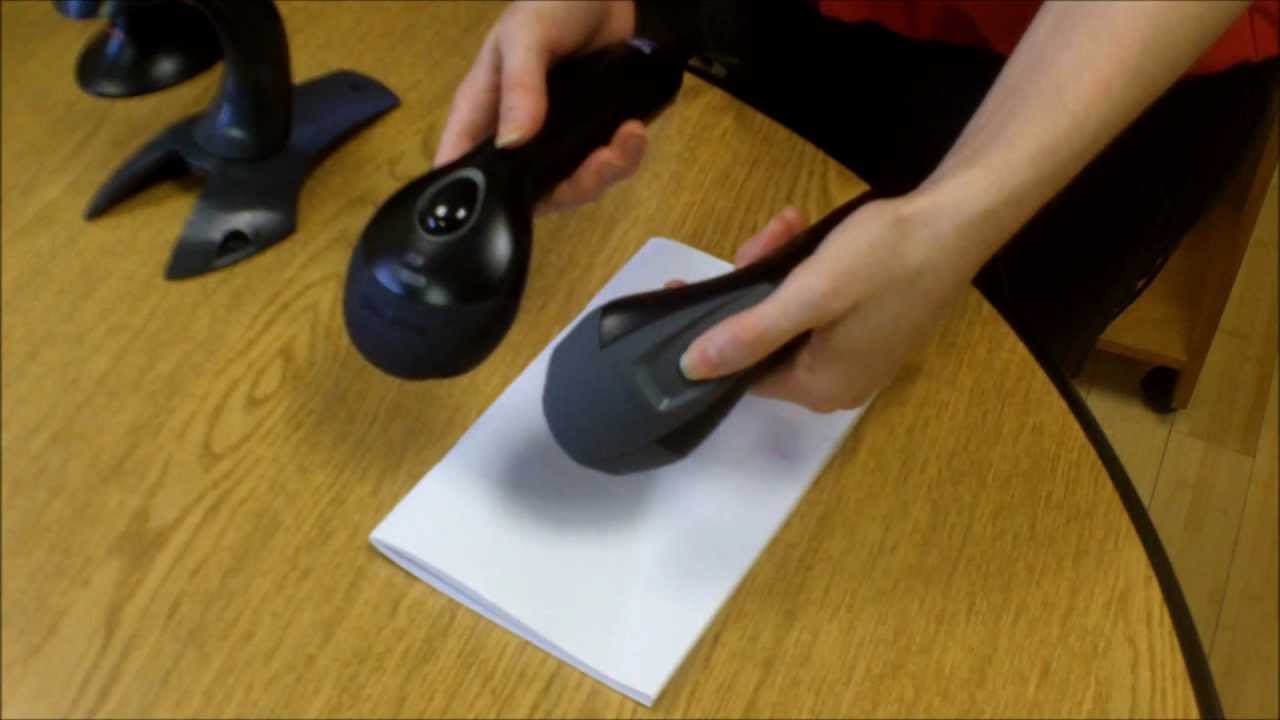

Honeywell-Lecteur de codes-barres laser USB, original, Voyager 1200G, avec support, sensibilité de balayage, lecture facile du code-barres flou

Scanner de code à barres de poche HONEYWELL VOYAGER 1200G - 1D, GS1 - Interface RS-232, USB - Noir - Cdiscount Informatique

:strip_icc():strip_exif()/bilder/s18/18403022_112.jpg)