NERF Power Moves Marvel Avengers Captain America Lanceur de bouclier, jouet lance-disque NERF pour jeu de rôle - Walmart.ca

Blaster Redwing Captain America - Nerf Marvel Hasbro : King Jouet, Nerf et jeux de tirs Hasbro - Jeux d'extérieur

Pistolet de lancement de bouclier Captain America, Marvel Avengers Captain America Shield Sling pour enfants, jeu de rôle Avengers, costumes de super-héros, jouet de rôle pour garçon : Amazon.fr: Jeux et Jouets

Blaster Redwing Captain America - Nerf Marvel Hasbro : King Jouet, Nerf et jeux de tirs Hasbro - Jeux d'extérieur

Hasbro European Trading B.V. - AVENGERS - Bouclier Deluxe Captain America - B5781EU40 - Films et séries - Rue du Commerce

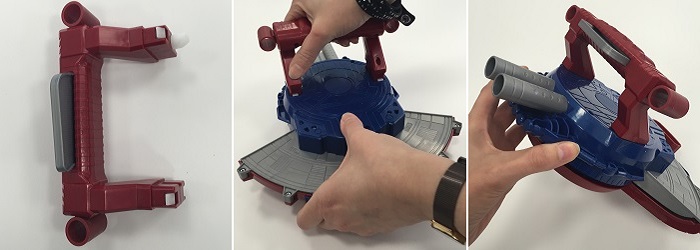

NERF Power Moves Marvel Avengers Captain America Lanceur de bouclier, jouet lance-disque NERF pour jeu de rôle - Walmart.ca