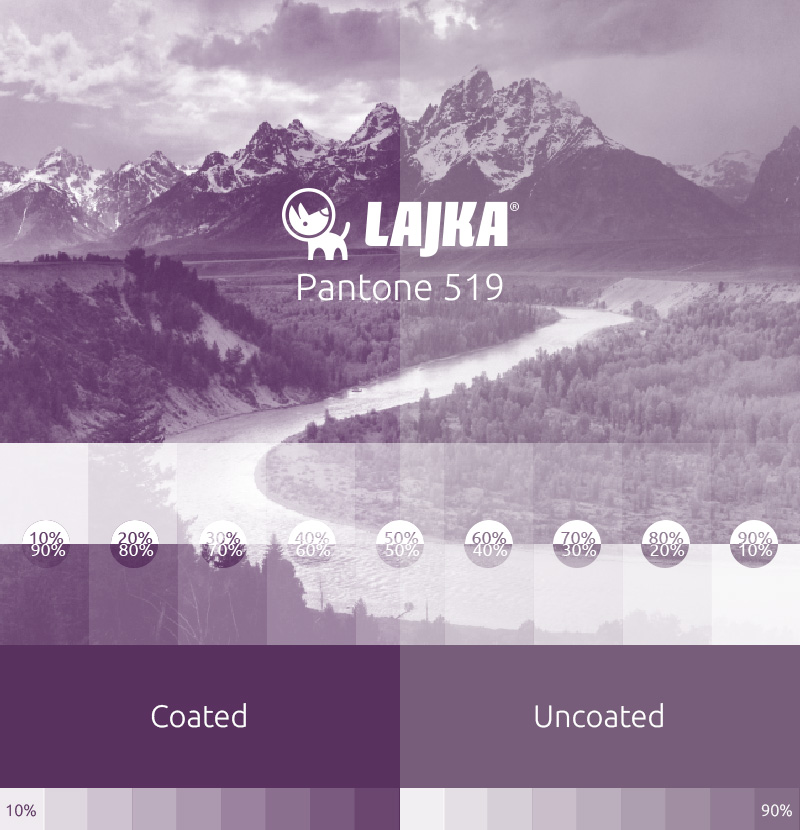

AGC The Creative Advantage: PANTONE & Color Marketing Group Predict "Next" Hot Colors | Purple palette, Coral colour palette, Pantone color

PANTONE Espresso Cup, small coffee cup, fine china (ceramic), 120 ml, Green : Amazon.fr: Cuisine et Maison