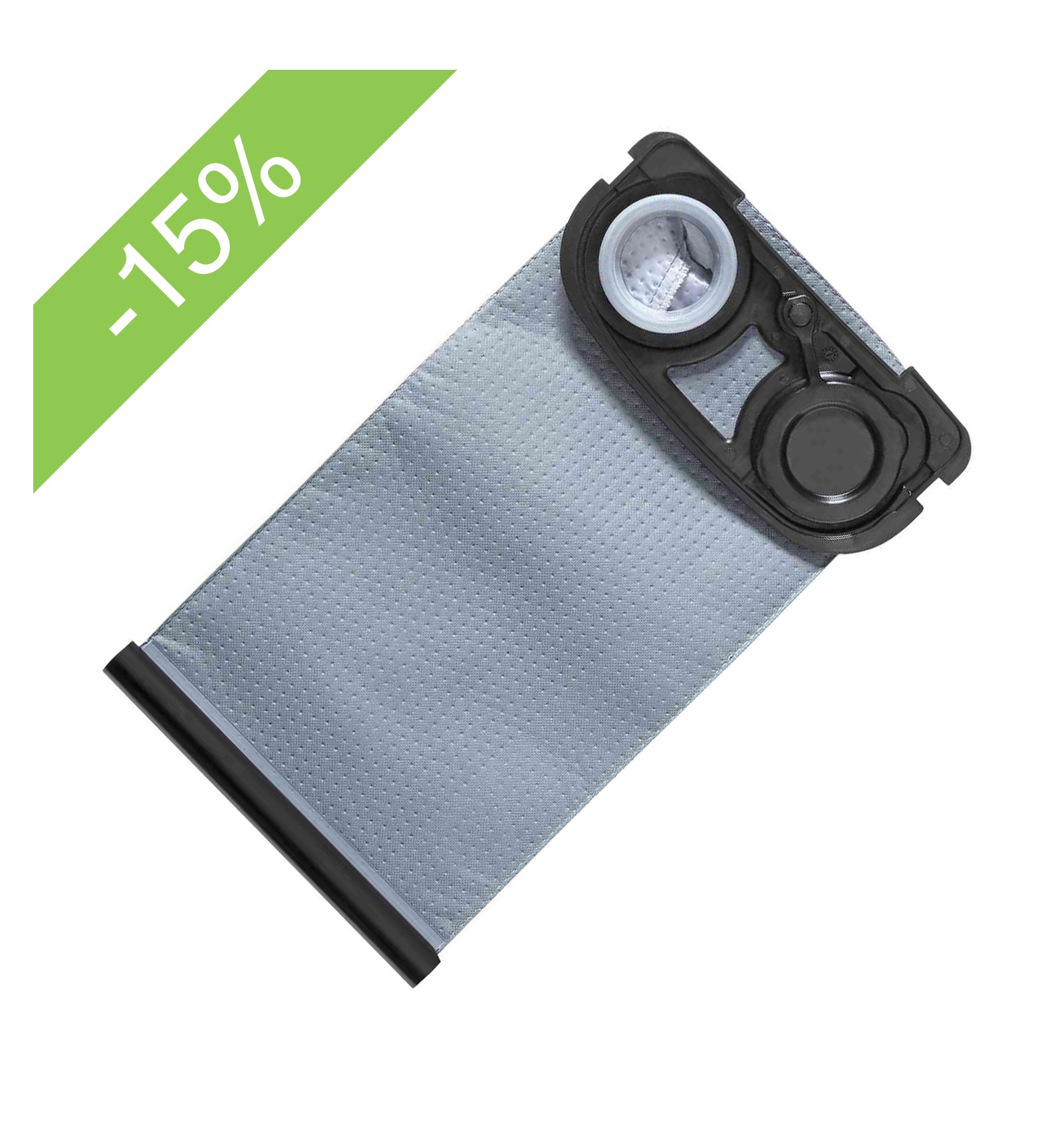

Festool Sac filtre FESTOOL Longlife-FIS-CTL MIDI - 499704 (Pour CT MIDI avant 2018) : Amazon.fr: Bricolage

Festool 499704 Longlife-Filtersack Longlife-FIS-CTL MIDI in Baden-Württemberg - Ulm | eBay Kleinanzeigen ist jetzt Kleinanzeigen

Festool Sac filtre FESTOOL Longlife-FIS-CTL MIDI - 499704 (Pour CT MIDI avant 2018) : Amazon.fr: Bricolage

vhbw 50x sacs compatible avec Festo / Festool CT, CTL Midi, CTL Mini, CT Mini, FIS-CTL Mini, FIS-CT Mini aspirateur - papier