TAG Heuer Watch Carrera Monaco Grand Prix Limited Edition CV2A1M.BA0796 Watch | Luxury watches for men, Mens tag heuer watches, Tag heuer watch

TAG Heuer x Grand Prix De Monaco Historique Calibre HEUER02 Automatic Homme 39 mm - CBL2114.FC6486 | TAG Heuer FR

TAG HEUER Monaco Grand Prix de Monaco Historique 1000 Lot Limited Hommes Acier Noir ref.487078 - Joli Closet

TAG Heuer - Carrera Monaco Grand Prix Limited Edition - CAR2A83.FT6033 - Homme - 2011-aujourd'hui - Catawiki

HANDS-ON: The TAG Heuer X Grand Prix de Monaco Historique Limited Edition is a red rocket for the wrist

Votre accès direct pour la première journée du Grand Prix de Monaco Historique | TAG Heuer Official Magazine

La Cote des Montres : La montre TAG Heuer Monaco Édition Spéciale - Une nouvelle édition spéciale pour le Grand Prix de Formule 1 de Monaco

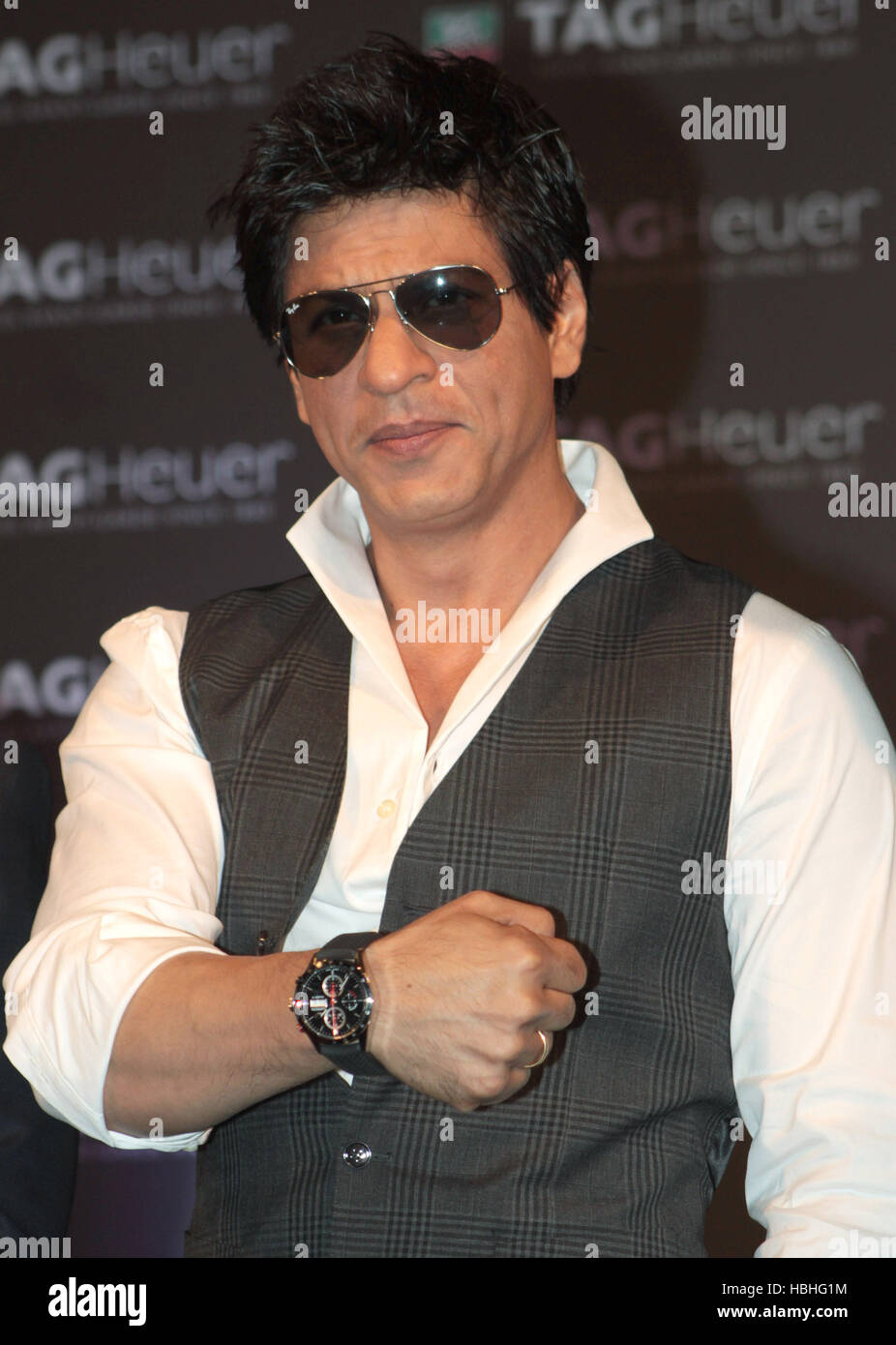

Shah Rukh Khan, acteur indien de Bollywood montrant LE TAG Heuer «Monaco Grand Prix» Limited Edition Chronographe montre à Mumbai, Inde Photo Stock - Alamy