Выпрямитель для волос Rowenta SF4630F0 цены в Киеве и Украине - купить в магазине Brain: компьютеры и гаджеты

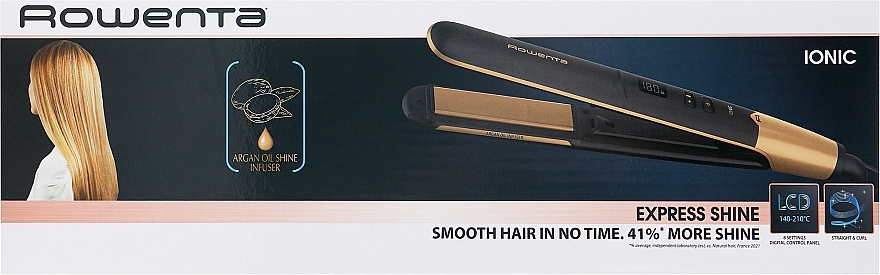

Rowenta SF4630F0 Express Shine Piastra per Capelli, Infusore di Olio di Argan, Ioni per Lucentezza, 8 Impostazioni di Temperatura, Arricciatura e stiratura 2 in 1. Nero/Oro : Amazon.it: Bellezza

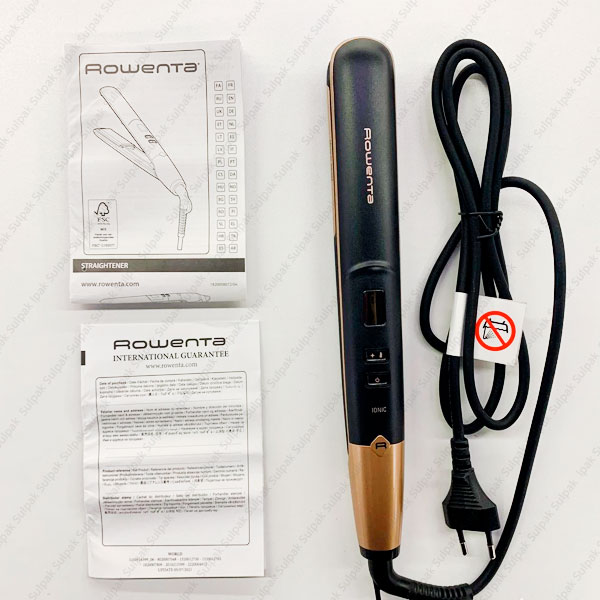

Выпрямитель Rowenta SF4630F0 в Алматы - цены, купить в интернет - магазине Sulpak | отзывы, описание

Випрямляч для волосся - Rowenta Express Shine Argan Oil SF4630F0: купити за найкращою ціною в Україні | Makeup.ua

Выпрямитель Rowenta SF4630F0 в Алматы - цены, купить в интернет - магазине Sulpak | отзывы, описание

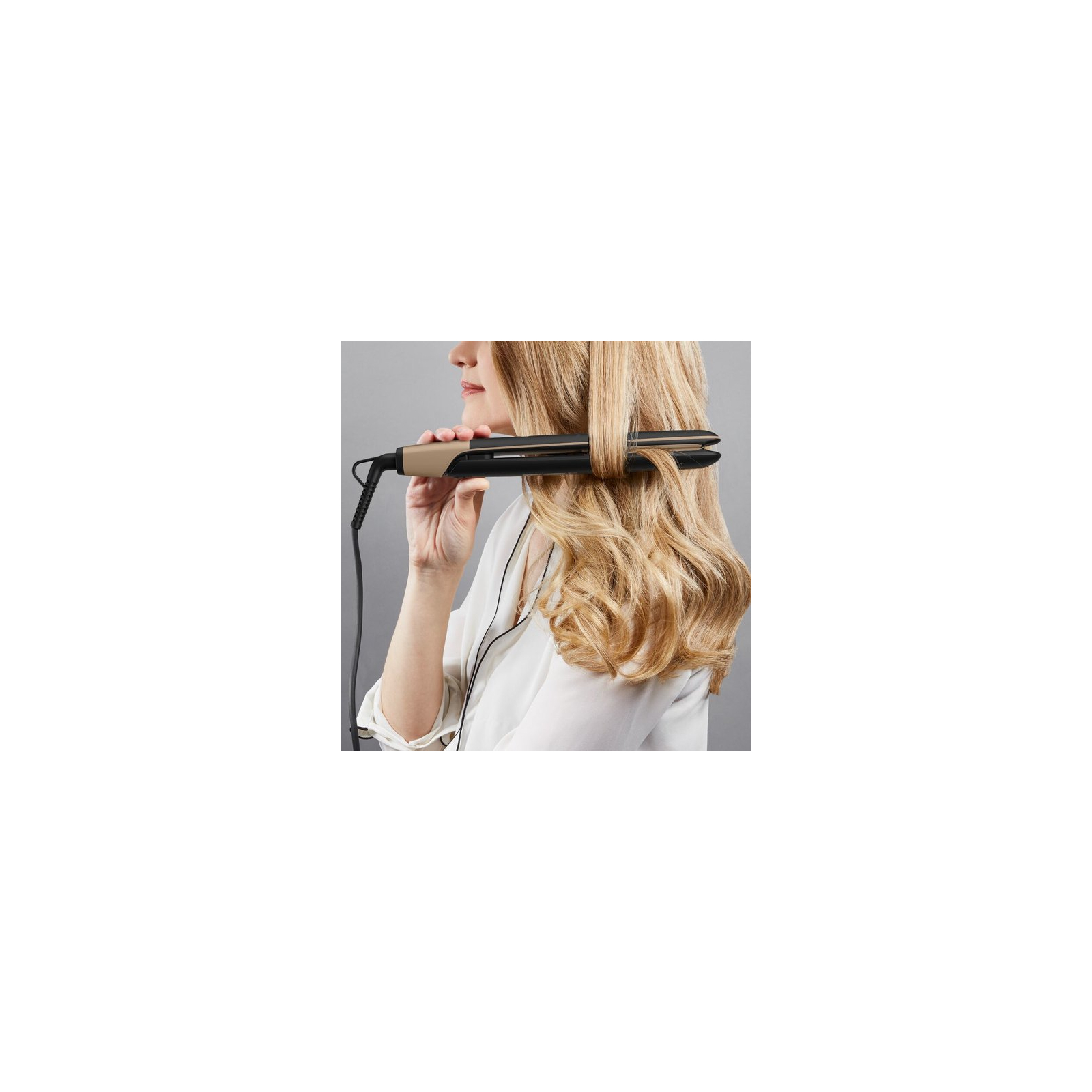

Rowenta Express Shine SF4630 Argan Oil Infuser - Ceramic Plates - Ionic Effect - 8 Temperature Settings - 2 in 1 Winding and Straightening - Healthy Hair - Black/Gold : Amazon.com.be: Beauty

Rowenta SF4630F0 Express Shine Piastra per Capelli, Infusore di Olio di Argan, Ioni per Lucentezza, 8 Impostazioni di Temperatura, Arricciatura e stiratura 2 in 1. Nero/Oro : Amazon.it: Bellezza

Выпрямитель волос Rowenta Express Shine Argan Oil SF4630F0 - купить с доставкой по выгодным ценам в интернет-магазине OZON (760436004)