Crucial P1 500Go CT500P1SSD8 SSD Interne-jusqu'à 1900 MB/s (3D NAND, NVMe, PCIe, M.2) : Amazon.fr: Informatique

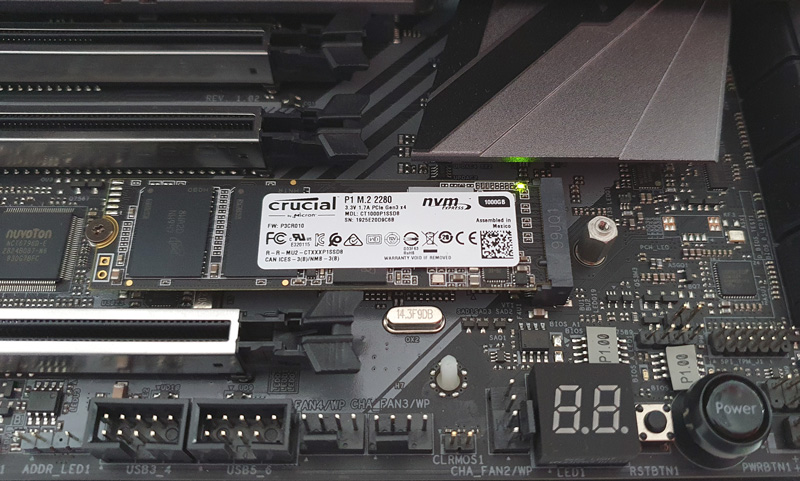

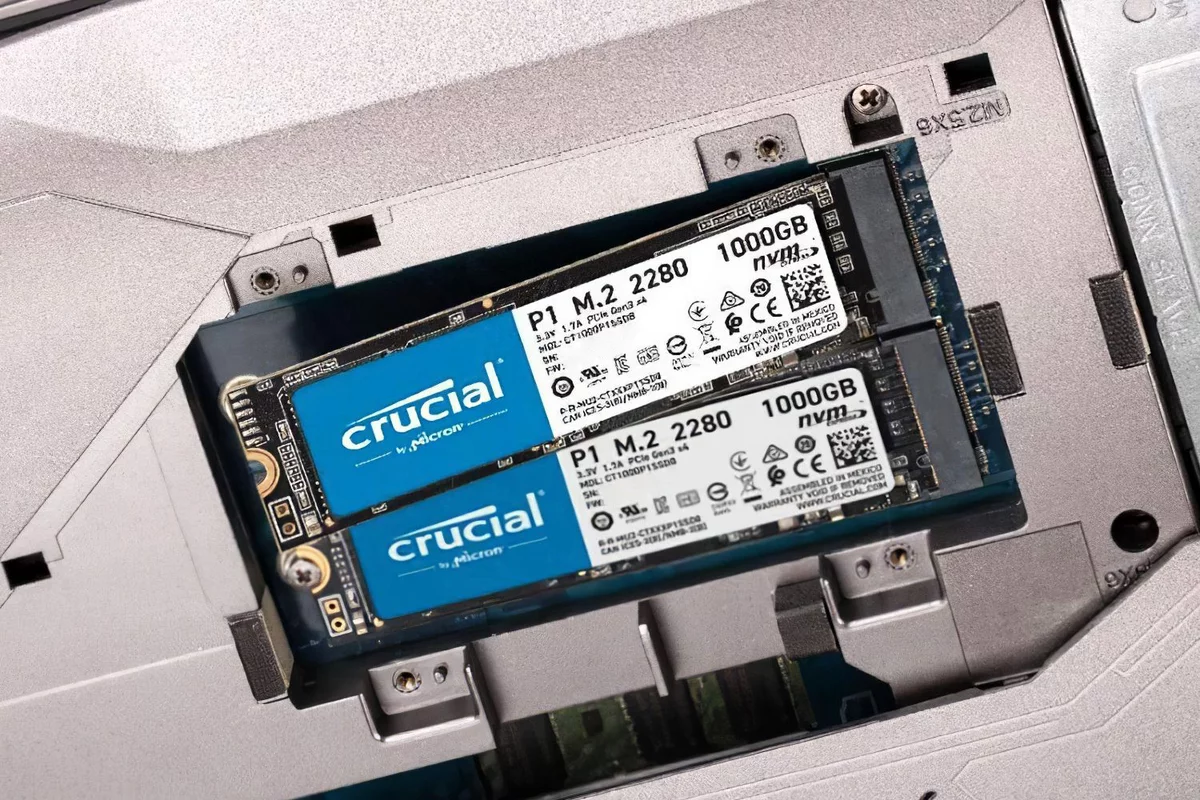

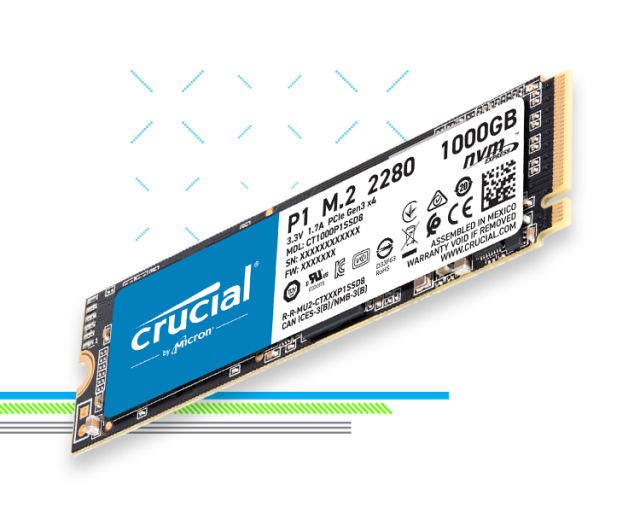

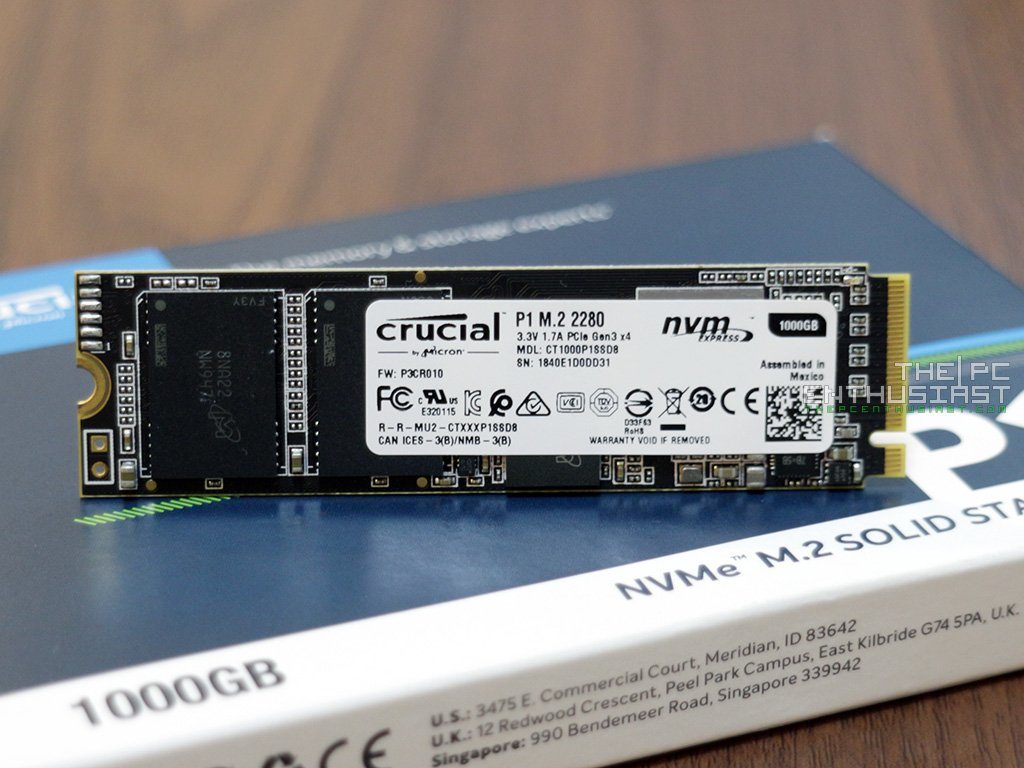

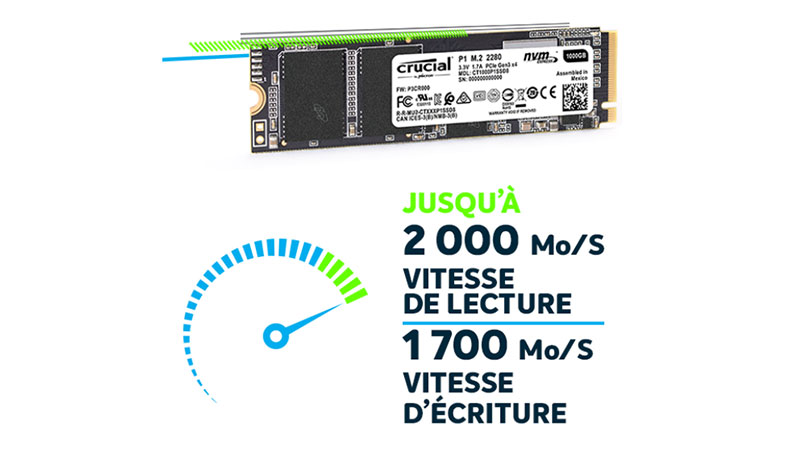

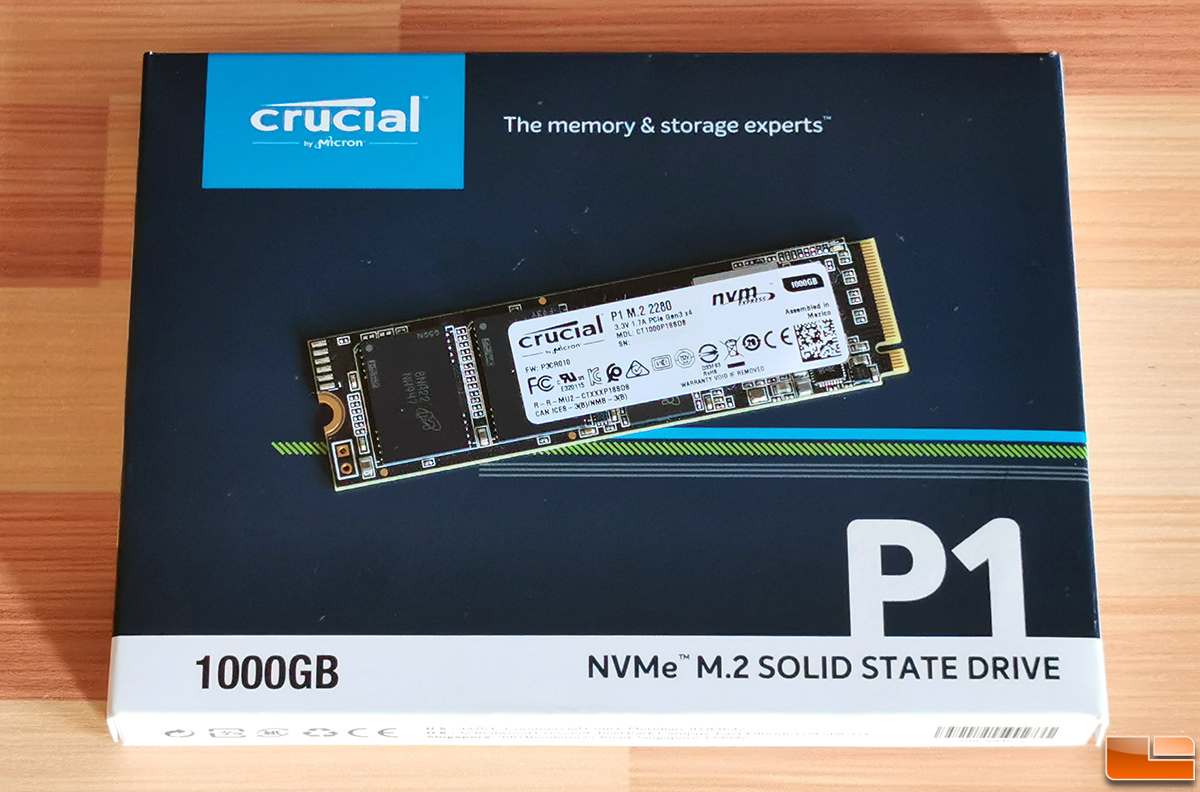

Crucial P1 1To CT1000P1SSD8 SSD Interne-jusqu'à 2000 MB/s (3D NAND, NVMe, PCIe, M.2) : Amazon.fr: Informatique

Crucial P1 1To CT1000P1SSD8 SSD Interne-jusqu'à 2000 MB/s (3D NAND, NVMe, PCIe, M.2) : Amazon.fr: Informatique

Crucial P1 1To CT1000P1SSD8 SSD Interne-jusqu'à 2000 MB/s (3D NAND, NVMe, PCIe, M.2) : Amazon.fr: Informatique

Crucial P1 500Go CT500P1SSD8 SSD Interne-jusqu'à 1900 MB/s (3D NAND, NVMe, PCIe, M.2) : Amazon.fr: Informatique

Crucial P1 1To CT1000P1SSD8 SSD Interne-jusqu'à 2000 MB/s (3D NAND, NVMe, PCIe, M.2) : Amazon.fr: Informatique

Crucial P1 1To CT1000P1SSD8 SSD Interne-jusqu'à 2000 MB/s (3D NAND, NVMe, PCIe, M.2) : Amazon.fr: Informatique