ACS355-01E-02A4-2 | Variateur de fréquence ABB ACS355, 0,37 kW 230 V c.a. 1 phase, 2,4 A, 0 → 600Hz | RS

ACS355-01E-02A4-2 | Variateur de fréquence ABB ACS355, 0,37 kW 230 V c.a. 1 phase, 2,4 A, 0 → 600Hz | RS

Buy ABB ACS355 01E 02A4 2, 1 Phase, 0.37KW, 0.5HP, 2.4Amps, 200 240V AC , IP20 with C3 EMC Filter — Vashi Integrated Solutions

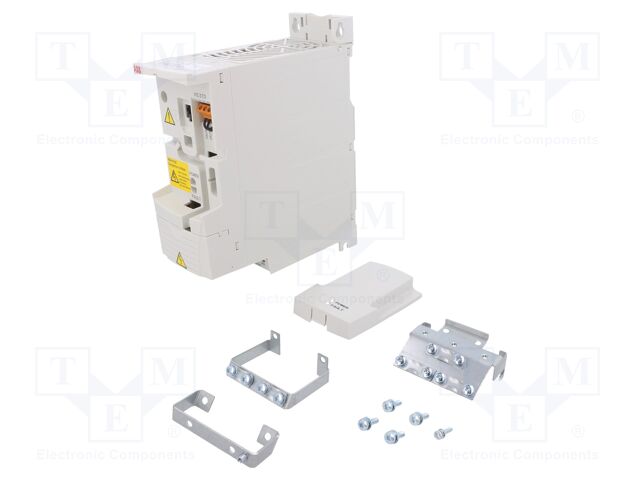

3AUA0000058186 ABB - Onduleur vecteur | Puissance de moteur max: 1,5kW; mural; 0÷599Hz; ACS355-03E-04A1-4 | TME - Composants électroniques

3AUA0000058166 ABB - Vector inverter | Max motor power: 0.37kW; Usup: 200÷240VAC; 2.4A; ACS355-01E-02A4-2 | TME - Electronic components

ABB ACS355 IP20 0.37kW 230V 1ph to 3ph AC Inverter Drive, DBr, STO, C3 EMC - AC Inverter Drives (230V)

ABB ACS355 IP20 0.37kW 230V 1ph to 3ph AC Inverter Drive, DBr, STO, C3 EMC - AC Inverter Drives (230V)

Variateur de fréquence AC ACS355 pour moteur monophasé ACS355-01E-07A5-2 kw, 220V, VxF Vector control, contrôleur de vitesse d'entraînement - AliExpress

ACS355-01E-02A4-2 | Variateur de fréquence ABB ACS355, 0,37 kW 230 V c.a. 1 phase, 2,4 A, 0 → 600Hz | RS

ACS355-01E-04A7-2 | Variateur de fréquence ABB ACS355, 0,75 kW 230 V c.a. 1 phase, 4,7 A, 0 → 600Hz | RS

ACS355-01E-09A8-2 | Variateur de fréquence ABB ACS355, 2,2 kW 230 V c.a. 1 phase, 9,8 A, 0 → 600Hz | RS