Camus, Sartre, Kafka: los niveles de lectura dentro de las grandes obras literarias - Nokton Magazine

Franz Kafka with his sister Ottla before Oppelt House in Prague. Heritage Images/Getty Images | Cute instagram pictures, Literature, Albert camus quotes

T-shirt Albert Camus Portrait, Tee, Auteur, Écrivain, Étranger, Peste, Sartre, Kafka, Nietzsche, Dostoïevski, Cadeau mignon - Etsy France

Problematic Rebel: Melville, Dostoievsky, Kafka, Camus - Friedman, Maurice S.: 9780226263960 - AbeBooks

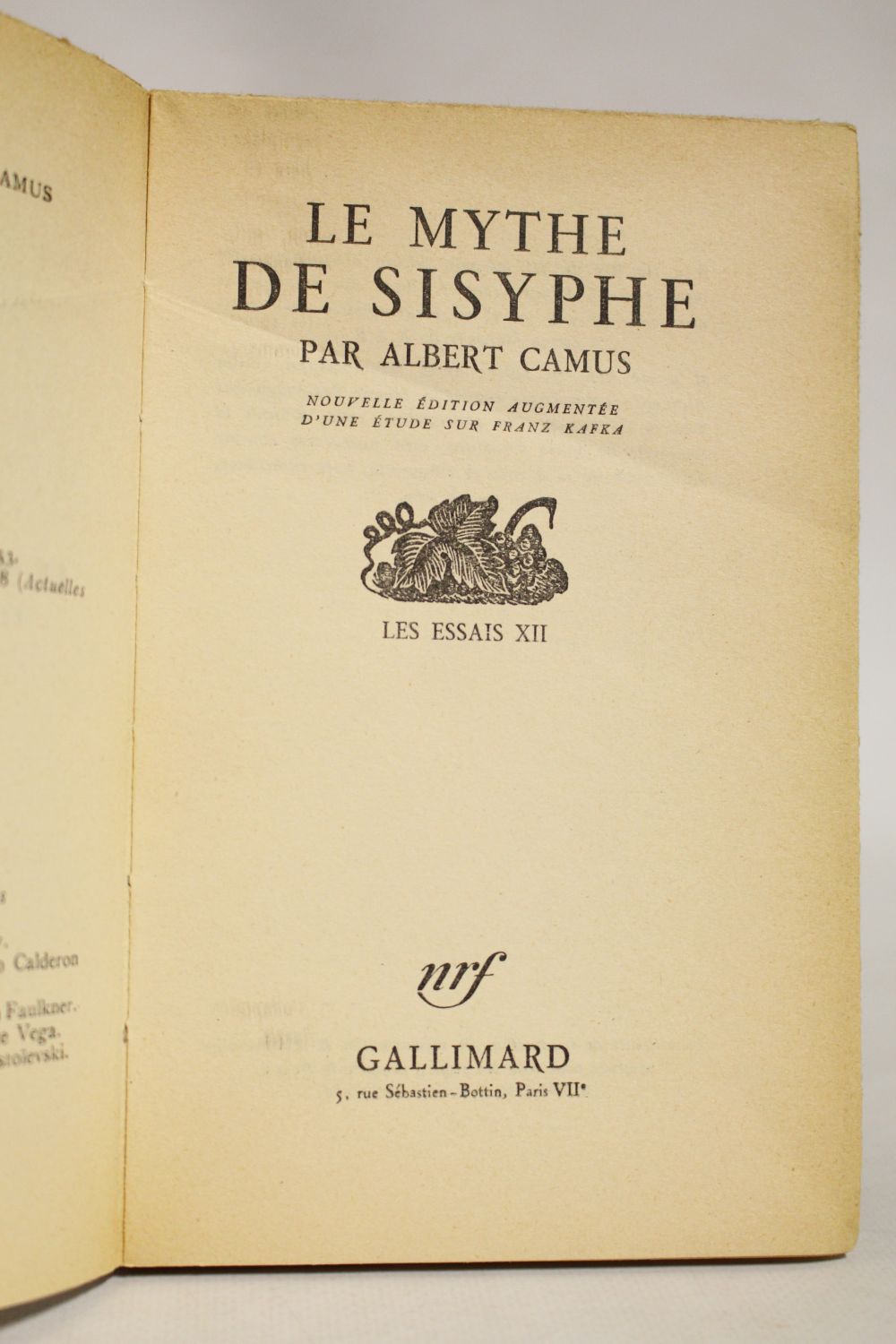

Le Mythe de Sisyphe - Par Albert Camus. Nouvelle édition, augmentée d'une... les Prix d'Occasion ou Neuf

Le mythe de Sisyphe. Essai sur l'absurde. Nouvelle édition augmentée d'une Étude sur Franz Kafka. by Albert Camus: Buono (Good) rilegato (1953) | librisaggi

Tod und Absurdität im Vergleich zwischen "Der Fremde" von Albert Camus und "Der Prozess" von Franz Kafka - Hausarbeiten.de | Hausarbeiten publizieren