SHIMANO NEXUS SG C6001 8D Moyeu de Transmission 8 Transition Centerlock Disque EUR 115,91 - PicClick FR

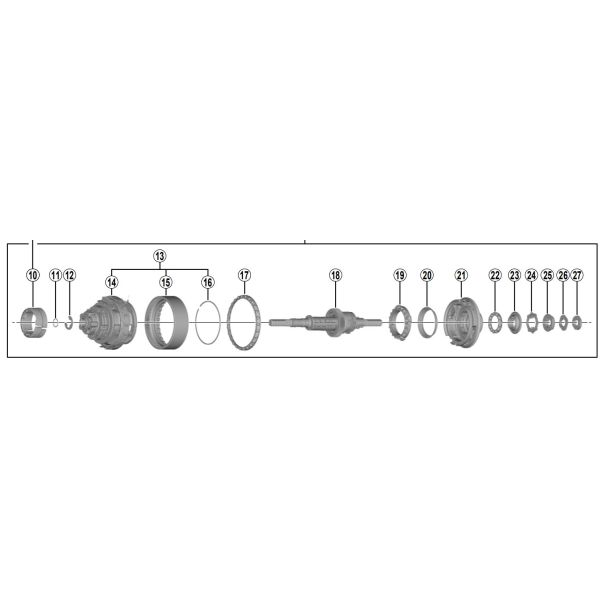

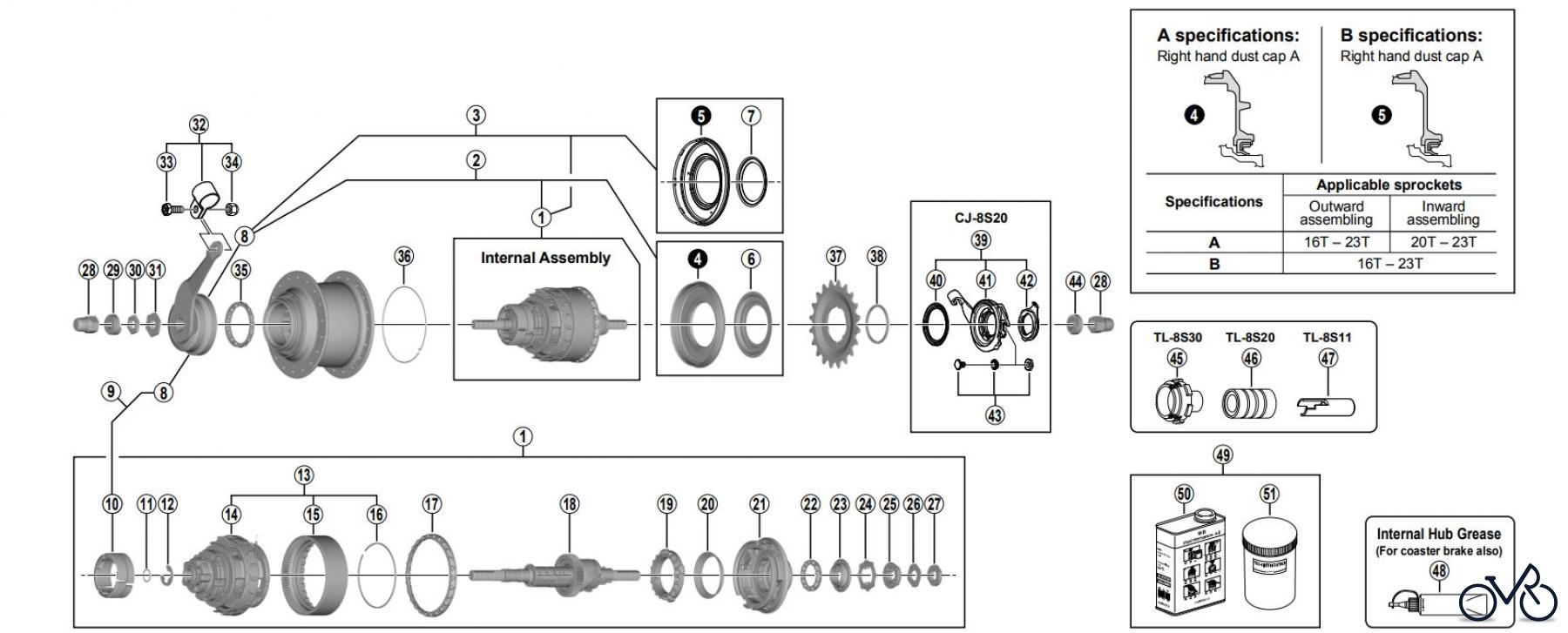

Shimano SG-C6001-8C (-4041A) NEXUS 8-Speed Internal Hub w/Coaster Brake Ersatzteile Y-70800300 TL-8S30 Carrier Unit Tool A

WinterMANO NEXUS C6000 Moyeu à engrenages internes SG-C6000-8C SG-8C20 SG- C6001-8D et manette de vitesse SL-C6000-8 SL-S500 SL-S7000-8 pièces d'origine

WinterMANO NEXUS C6000 Moyeu à engrenages internes SG-C6000-8C SG-8C20 SG- C6001-8D et manette de vitesse SL-C6000-8 SL-S500 SL-S7000-8 pièces d'origine

Moyeu vitesses intégrées Shimano Nexus SG-C6001-8C - Pièces détachées - Roues et Pneus - Pièces détachées