.jpg)

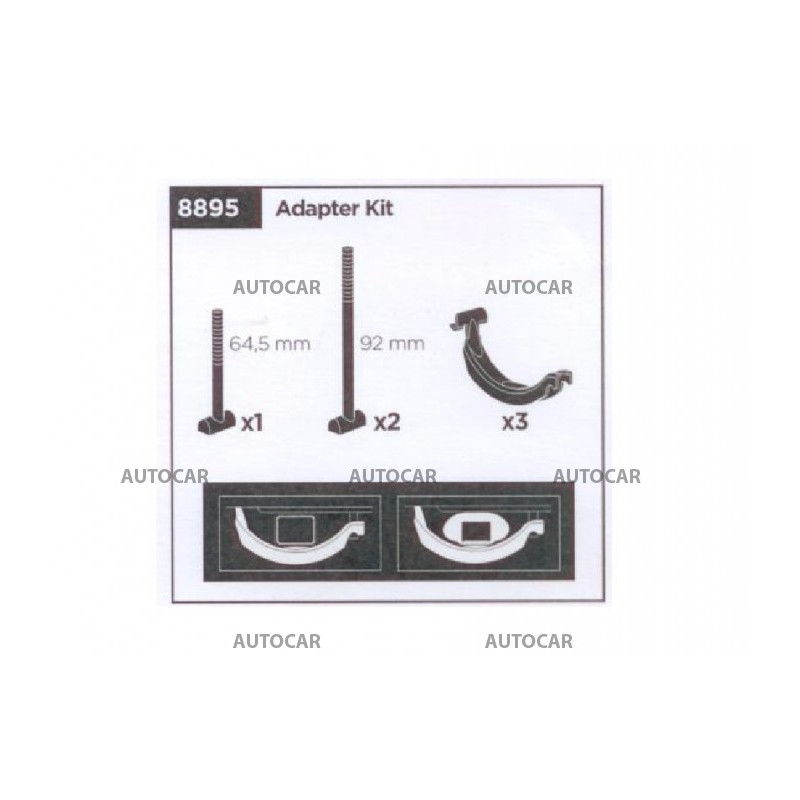

Адаптер Thule 889-5 для стандартного профиля для ProRide 591/598 — купить в интернет-магазине Движком

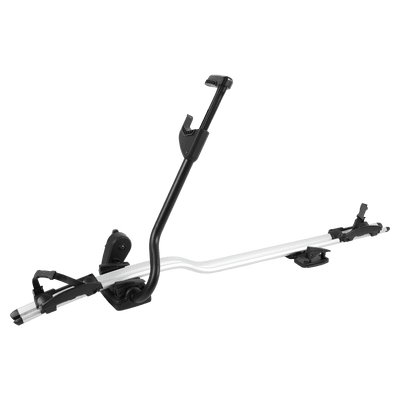

8895 Adapter Thule ProRide SquareBar Adapter für Fahrradträger Pro Ride 889- 5 889500 | spez. Wassersport Bootszubehör

porte-velos de toit ProRide 598 - pour 1 velo Fixation avec les rainures en T capacite de chargement: 20 kgchez Rameder