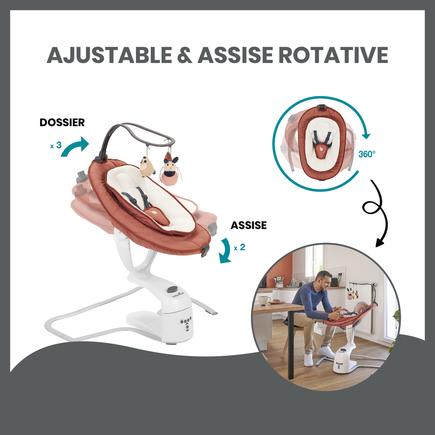

Babymoov Balancelle éléctrique bébé Swoon Motion Zinc - Assise rotative 360° - 5 vitesses de balancement - Réducteur nouveau-né & Arche de jeux inclus - 8 Berçeuses : Amazon.fr: Jeux vidéo

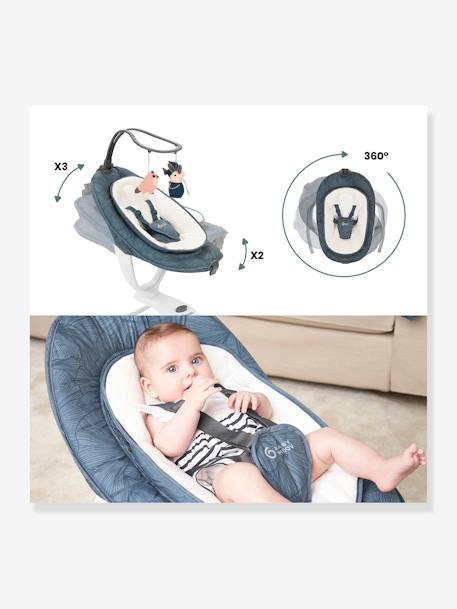

Babymoov Swoon Motion Balancelle Bébé Electrique 360° - Blue Petal - Transat et balancelle bébé - Achat & prix | fnac