Braun Series 5 Rasoir Électrique Homme À Grille Sans Fil Avec 3 Lames Flexibles, Tondeuse à Barbe, Accessoires EasyClick, Humide et Sec, M4500cs, Turquoise : Amazon.fr: Hygiène et Santé

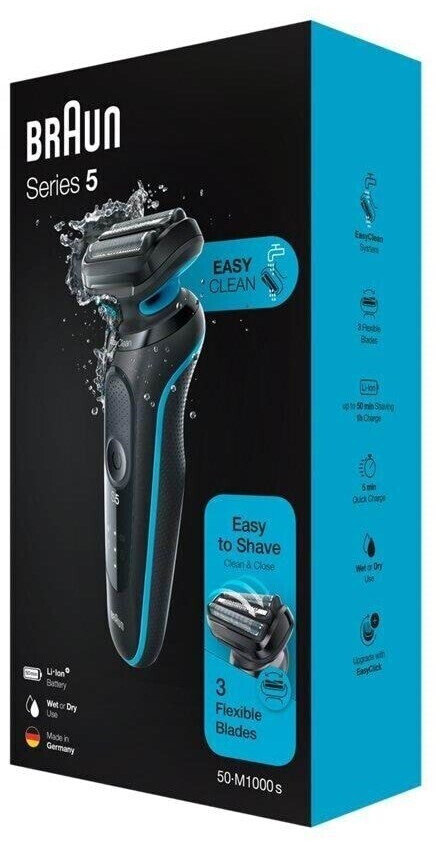

Braun Series 5 50-M1000s EasyClean - Rasoir - sans fil - menthe - Rasoir homme - Achat & prix | fnac

Braun Series 5 50 M1000S au meilleur prix - Comparez les offres de Rasoir electrique sur leDénicheur

BRAUN SERIES 5 50-M1000s Rasoir Électrique Sans fil Wet & Dry Neuf Scellé Cerclé EUR 87,90 - PicClick FR

Braun Series 5 50-M1000s EasyClean - Rasoir - sans fil - menthe - Rasoir homme - Achat & prix | fnac