Build a PC for Razer Iskur (RZ38-02770100-R3G1) Black/Green with compatibility check and price analysis

Build a PC for Razer Iskur (RZ38-02770100-R3G1) Black/Green with compatibility check and price analysis

Razer Iskur - Black / Green Gaming Chair with Built-in Lumbar Support - PC Kuwait - Ultimate IT Solution Provider in Kuwait

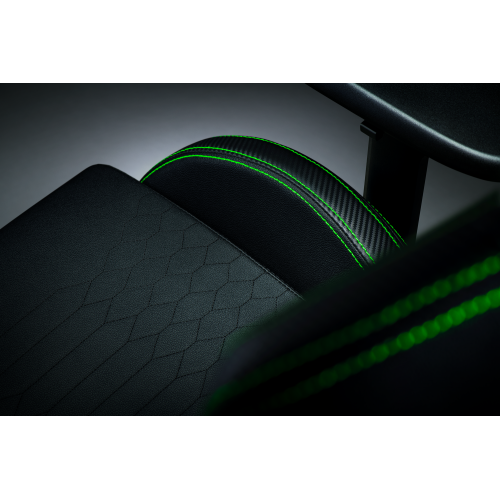

Razer Iskur Gaming Chair with Built-in Lumbar Support Multi-Layered Synthetic Leather Material - Black/Green

Купить Кресло для геймеров Razer Iskur (Green) (RZ38-02770100-R3G1) — цены ⚡, отзывы ⚡, характеристики — ЯБКО

Buy Razer Iskur / RZ38-02770100-R3G1 — in the best online store of Moldova. Nanoteh.md is always original goods and official warranty at an affordable price!