Vista Group, leader mondial en logiciels dans l'industrie du film, dévoile ses dernières innovations au salon CineEurope 2018 | Business Wire

VISTA, Passenger (Cruise) Ship - Détails du bateau et situation actuelle - IMO 9876957 - VesselFinder

Vistaprint devient Vista : le partenaire design, digital et impression des entreprises | Business Wire

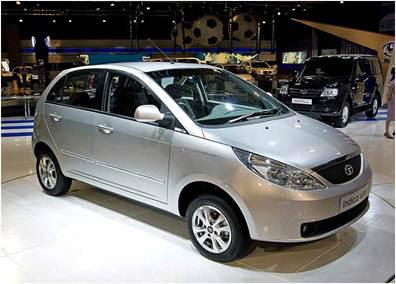

![Tata Indica Vista [2012-2014] Price - Images, Colors & Reviews - CarWale Tata Indica Vista [2012-2014] Price - Images, Colors & Reviews - CarWale](https://imgd.aeplcdn.com/1920x1080/ec/8313/img/l/6973.jpg?v=201711021421&q=80&q=80)