Puressentiel - Articulations et Muscles - Roller aux 14 Huiles Essentielles - Soulage les douleurs musculaires, articulaires et les courbatures – Dos, genoux, jambes du sportif - 75 ml : Amazon.fr: Hygiène et Santé

Puressentiel - Articulations et Muscles - Roller aux 14 Huiles Essentielles - Soulage les douleurs musculaires, articulaires et les courbatures – Dos, genoux, jambes du sportif - 75 ml : Amazon.fr: Hygiène et Santé

Puressentiel - Articulations et Muscles - Roller aux 14 Huiles Essentielles - Soulage les douleurs musculaires, articulaires et les courbatures – Dos, genoux, jambes du sportif - 75 ml : Amazon.fr: Hygiène et Santé

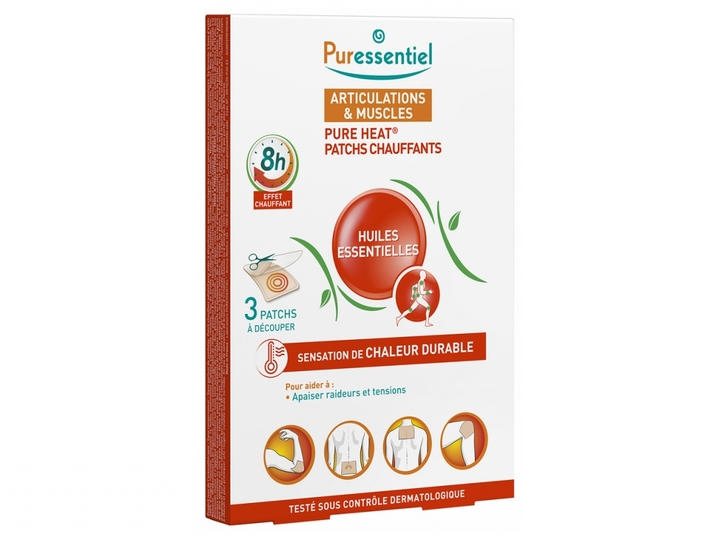

Action immédiate et durable pour soulager les douleurs musculo-articulaires et apaiser les contractures musculaires