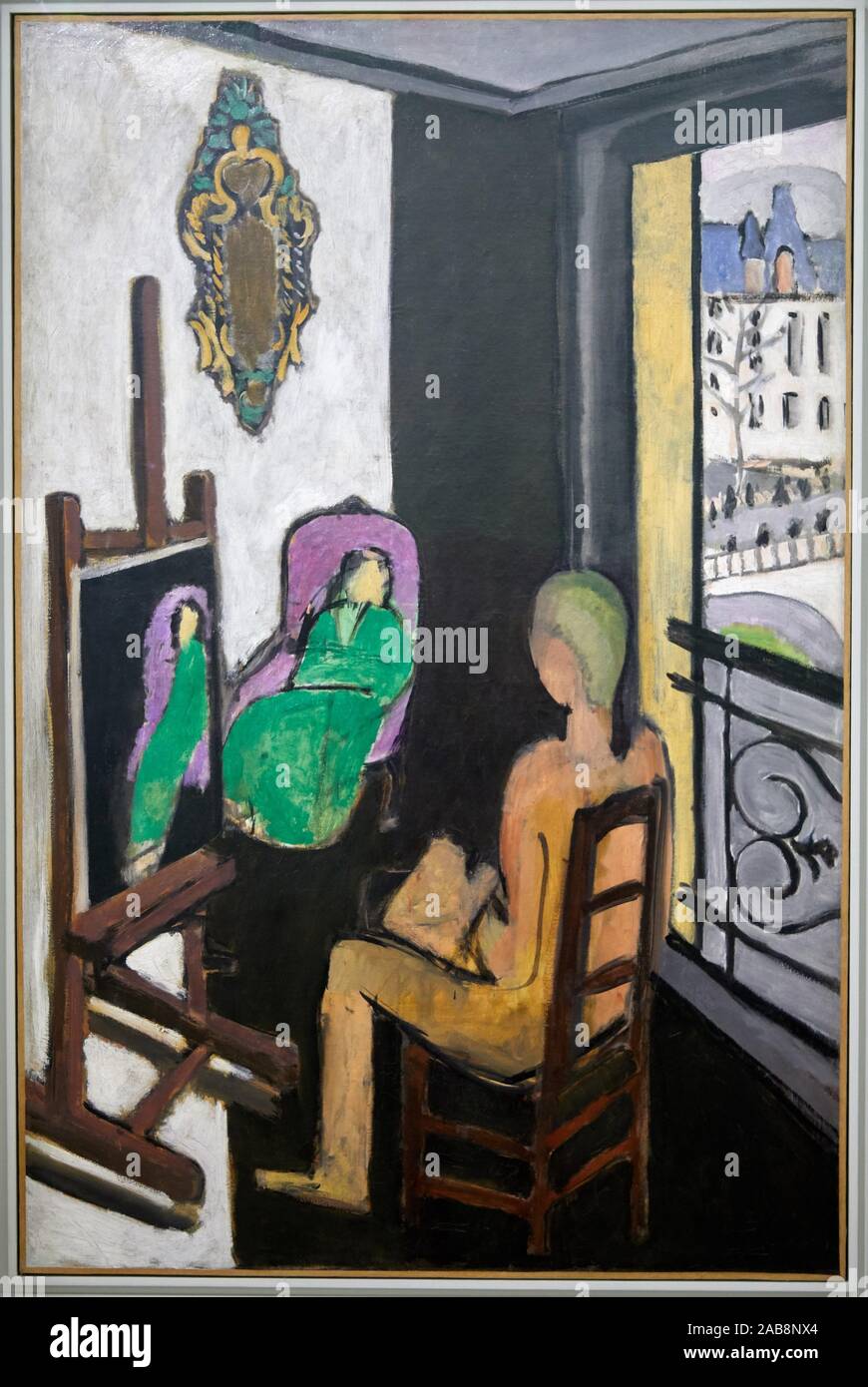

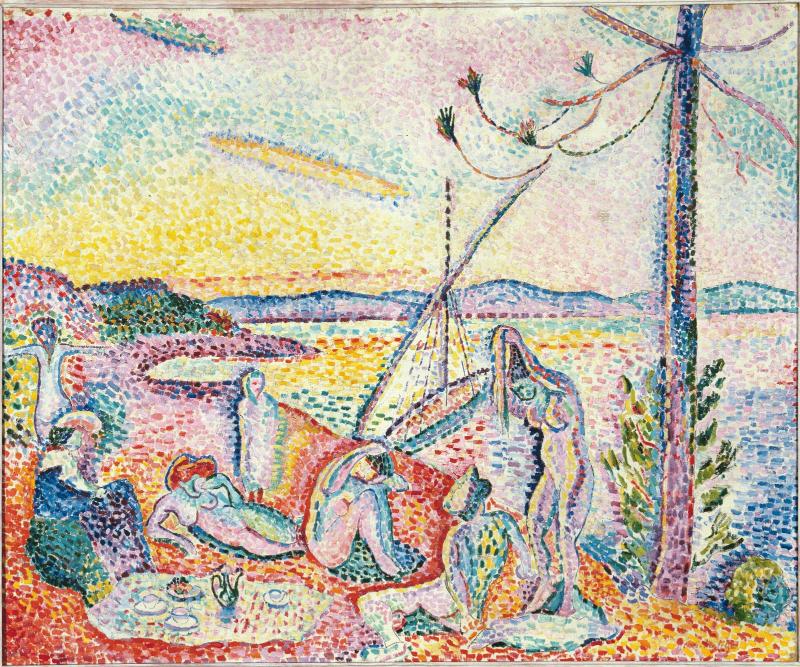

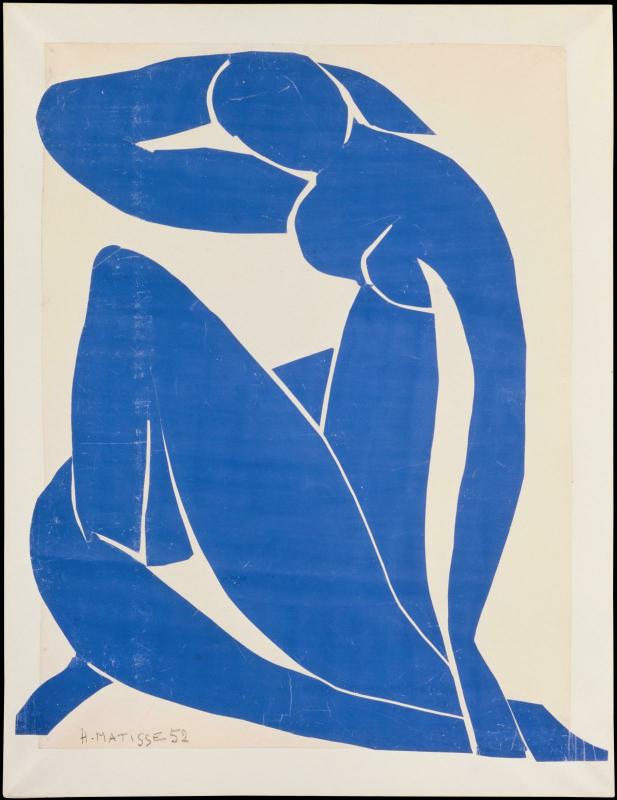

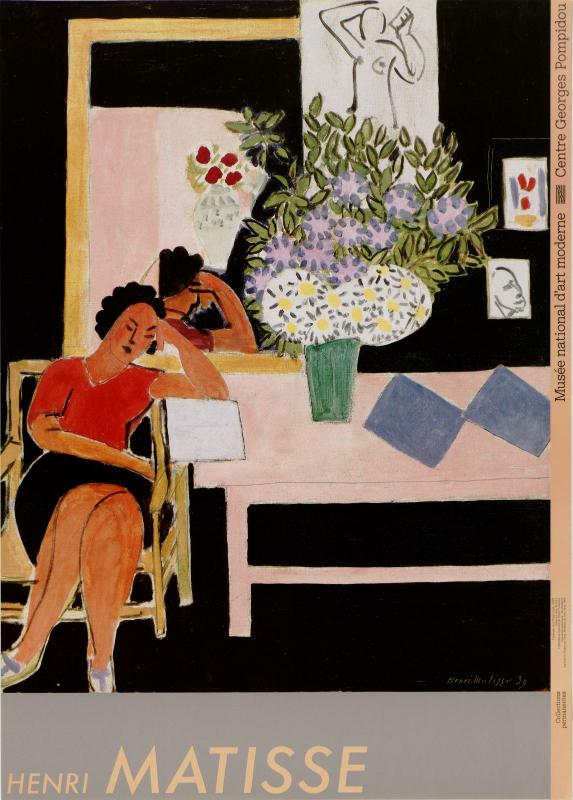

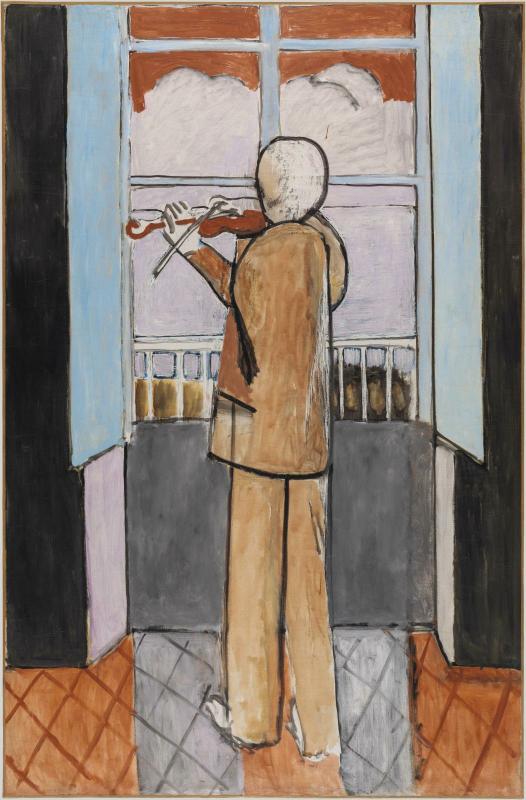

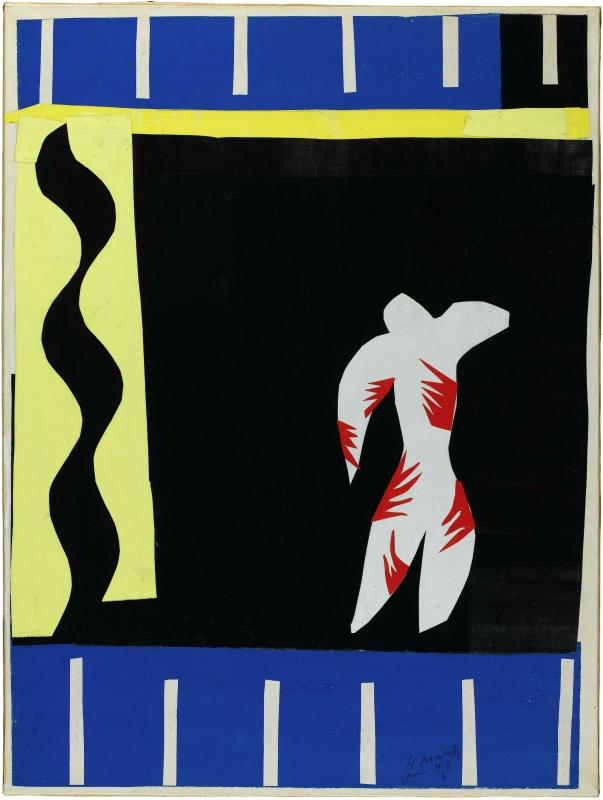

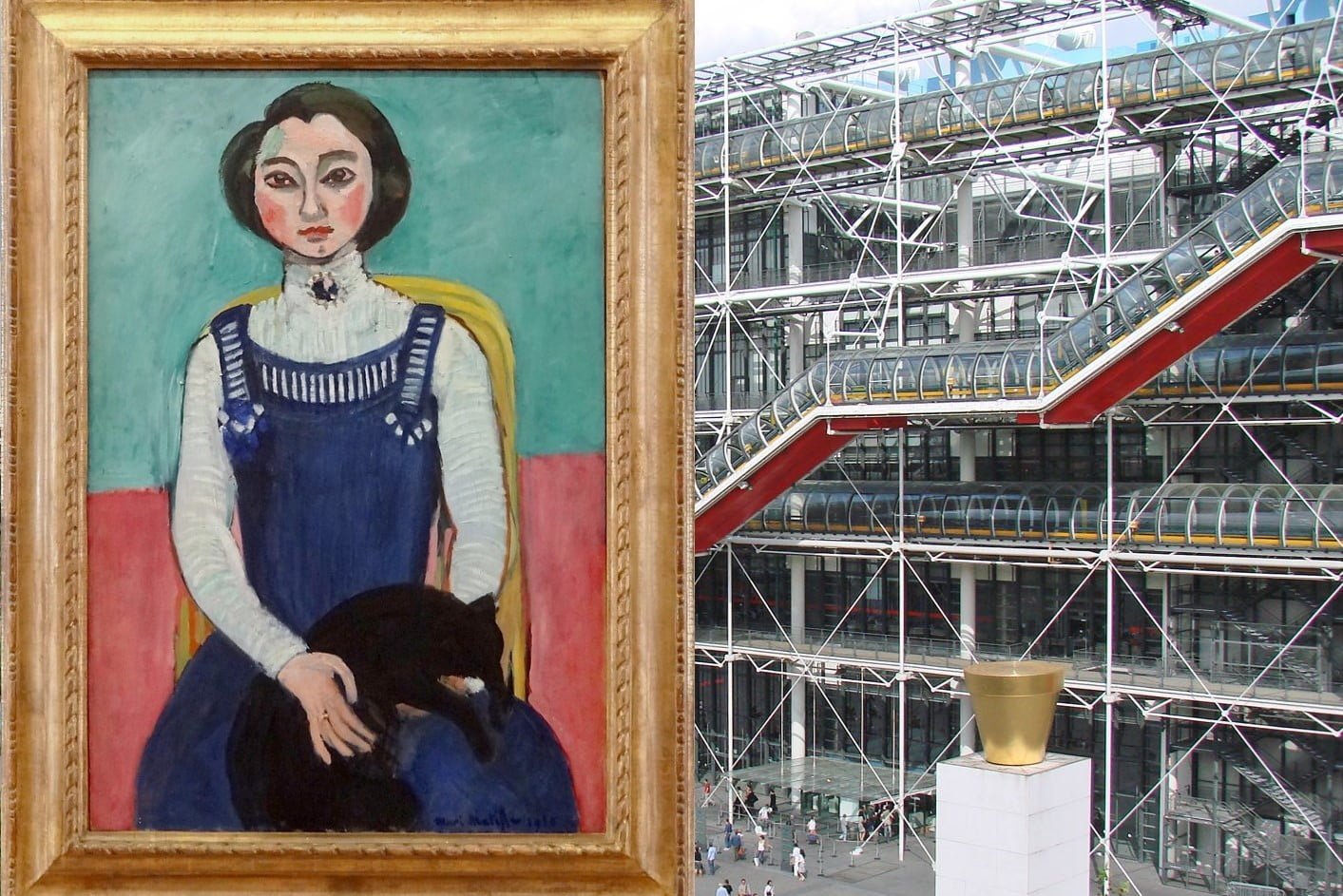

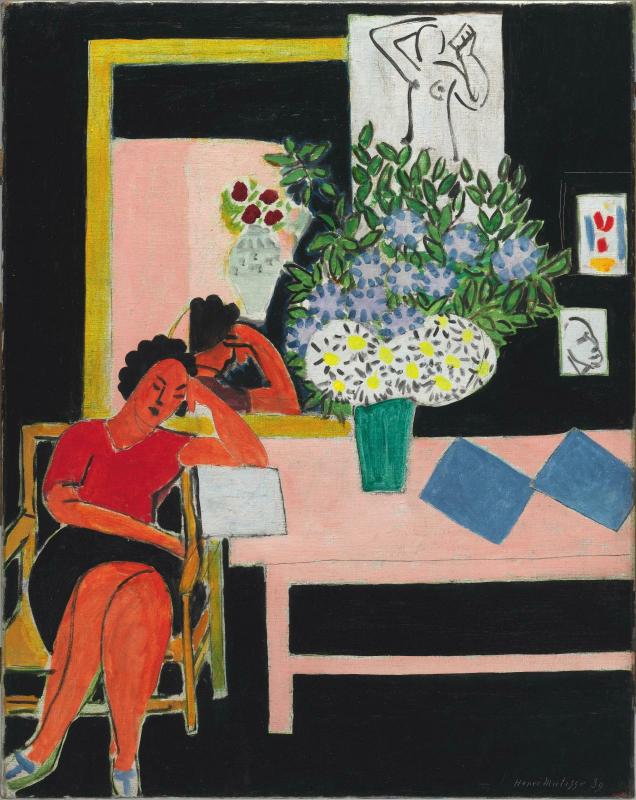

Deux chefs-d'œuvre de Matisse rejoignent les collections du Centre Pompidou grâce à une donation de la famille héritière

Centre Pompidou on X: "Notre #ExpoMatisse ouvre ses portes le 21 octobre ! Une exposition qui vous emmènera sur les traces du peintre Henri Matisse sur plus de 5 décennies au cours