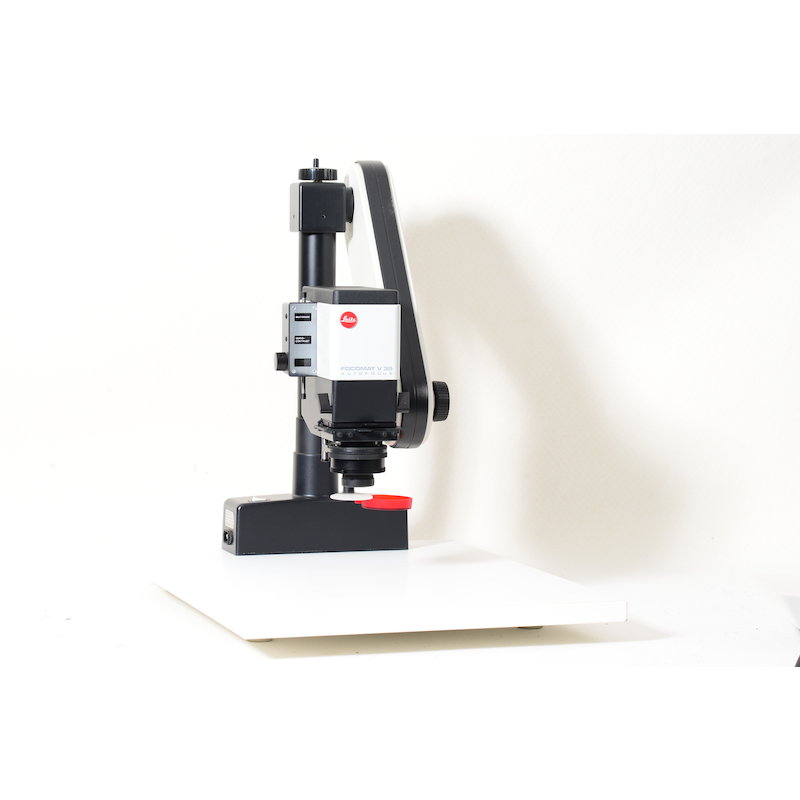

Agrandisseur photographique Leica Focomat V-35, de l'agrandisseur Leitz Focomat V Autofocus 35 Photo Stock - Alamy

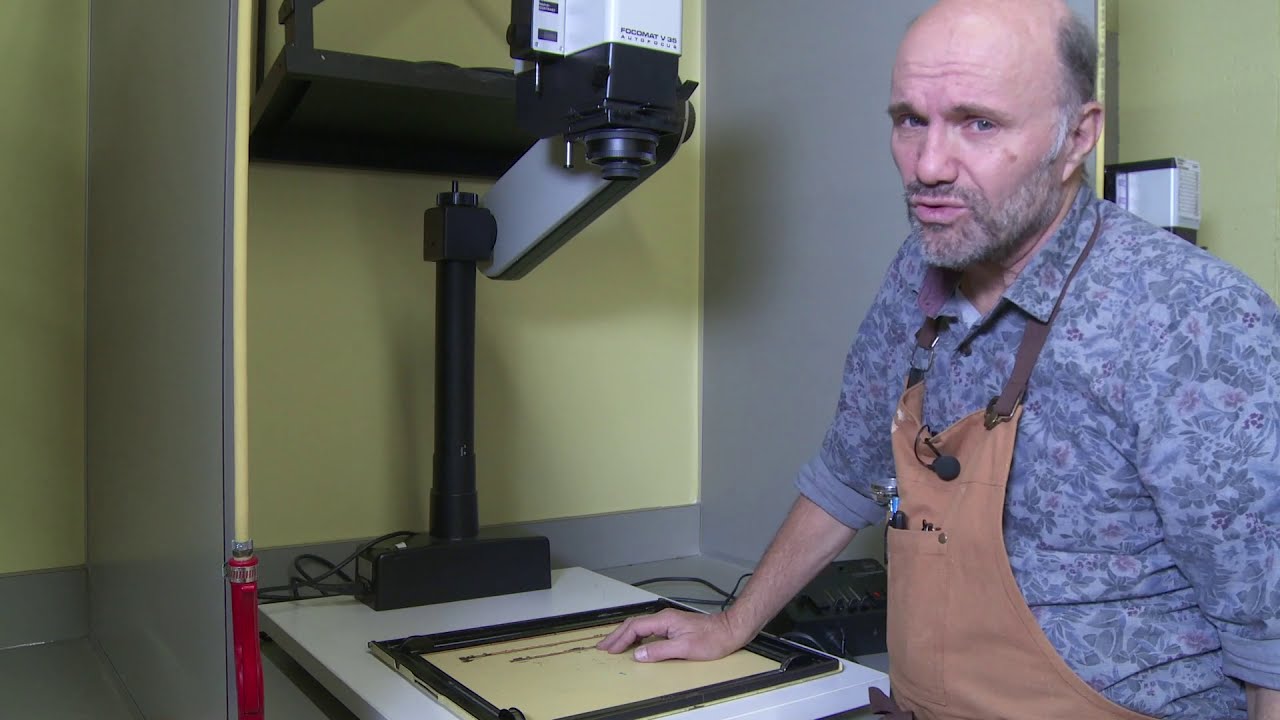

Leitz LEICA V35 FOCOMAT Colour 35mm ENLARGER +40mm Focotar LAST LIGHT BOX! – The Real Camera Company

LEITZ LEICA FOCOMAT V35 Enlarger - Multigrade Head, 40mm 1:2.8 Focotar Lens EUR 493,66 - PicClick FR

.jpg)