3SU1250-6KB10-1AA0 - Akustická signálka, instalace do panelu do otvoru 22mm, kovový - akustický tlak min. 90 dB/10 cm, 24 V AC/DC, šroubové svorky | iKeloc

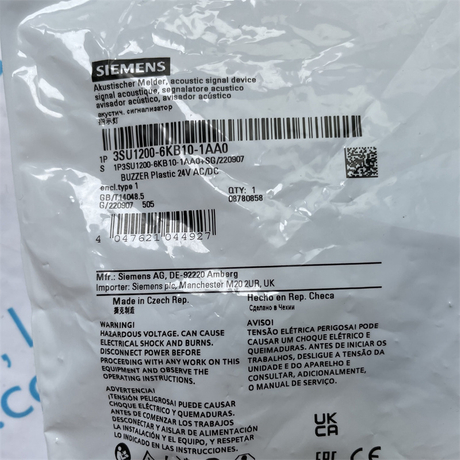

Siemens 3SU1200-6KB10-1AA0 ACOUSTIC SIGNAL DEVICE, COMPACT, 22 MM, ROUND, PLASTIC, BLACK, CONTINUOUS TONE 2.4 KHZ, IP40 | Kempston Controls

3SU1200-6KB10-1AA0 Acoustic Signal Device | 3SU1200-6KB10-1AA0 Siemens In Stock - Santa Clara Systems

SIEMENS indicator light 3SU1200-6KB10-1AA0 - Buy 3SU1200-6KB10-1AA0, SIEMENS indicator light, indicator light 3SU1200-6KB10-1AA0 Product on Shenzhen Juson Automation Company Limited

Siemens 3SU12006KB101AA0 Acoustic Signal Indicator, Plastic, IP40 Protection Rating, Plastic, 22mm, Black: Amazon.com: Industrial & Scientific

SIEMENS indicator light 3SU1200-6KB10-1AA0 - Buy 3SU1200-6KB10-1AA0, SIEMENS indicator light, indicator light 3SU1200-6KB10-1AA0 Product on Shenzhen Juson Automation Company Limited

.jpg)

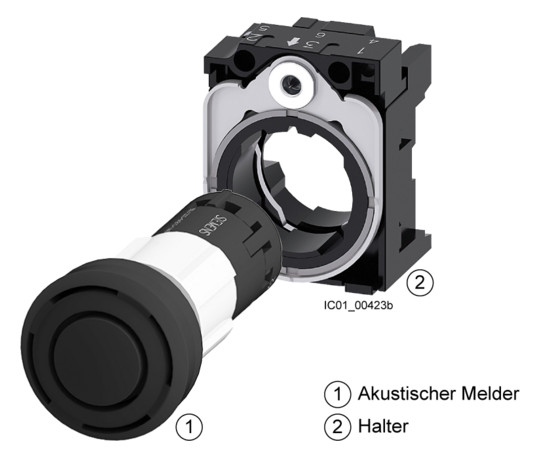

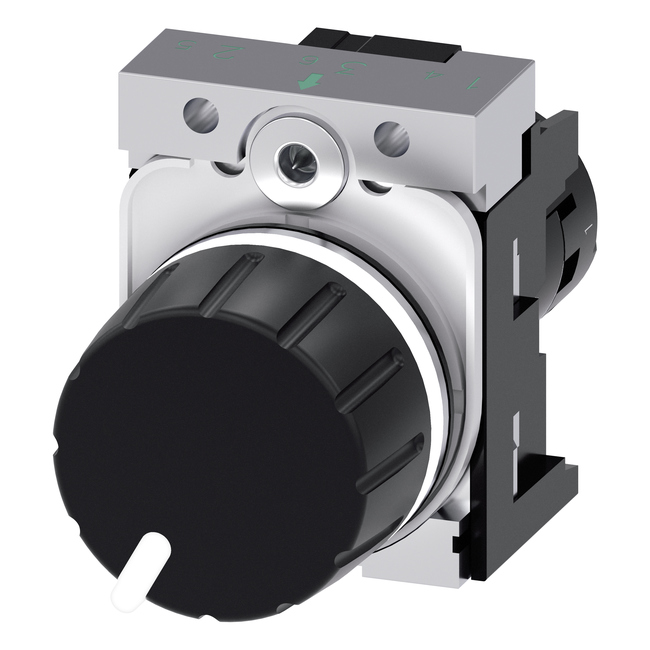

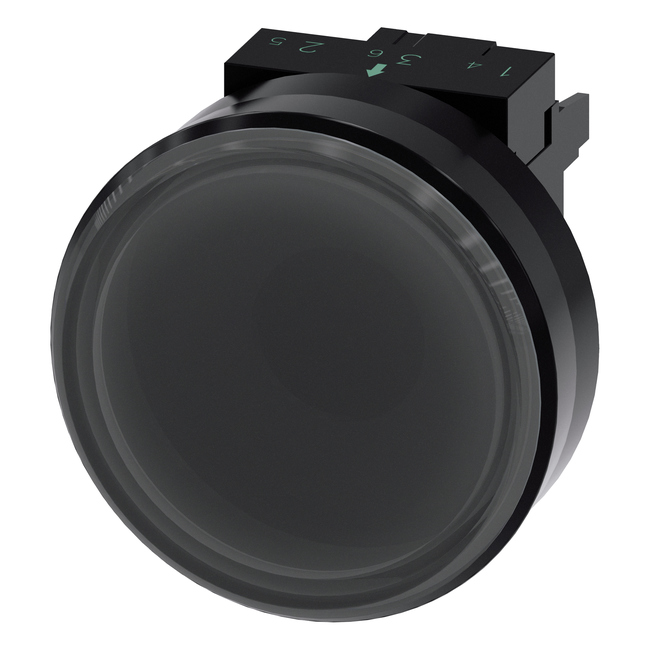

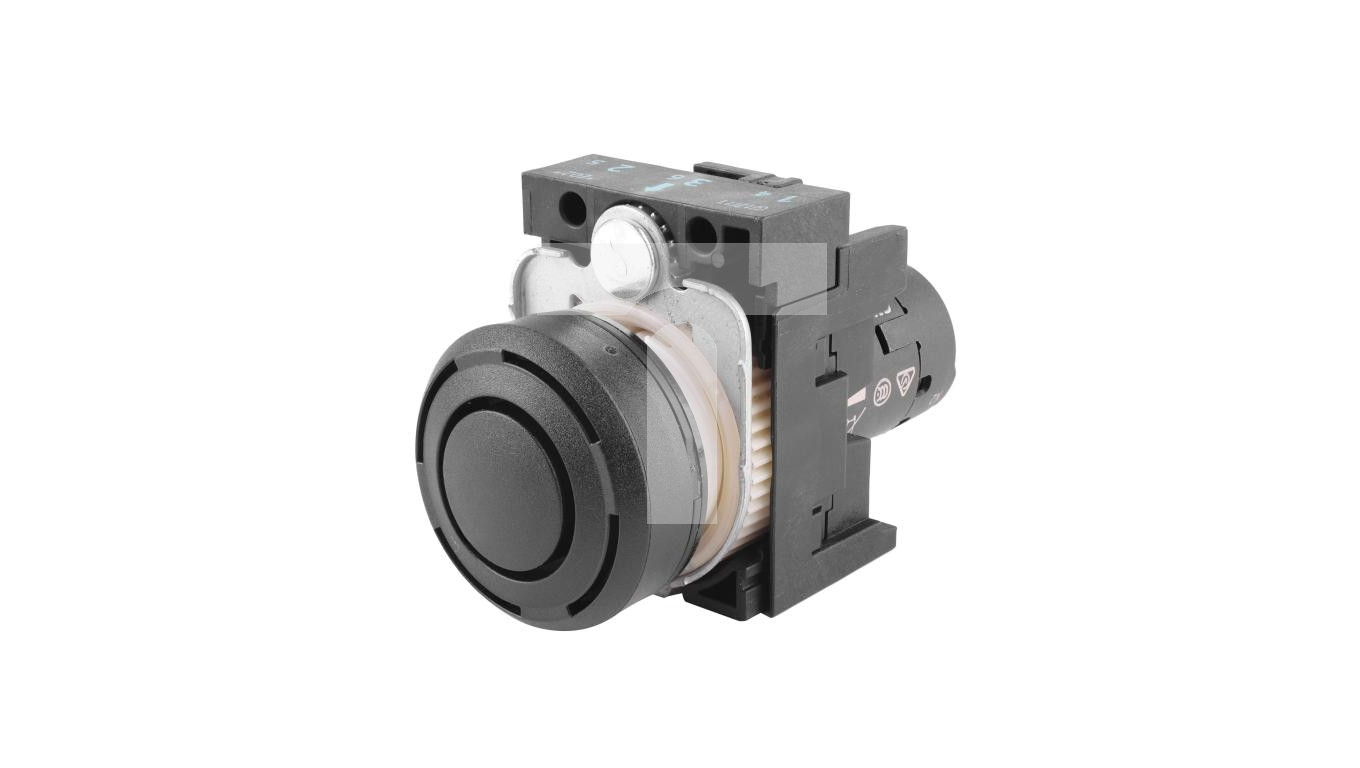

3SU1200-6KB10-1AA0. 3SU12006KB101AA0. ACOUSTIC SIGN. DEVICE, COMP., 22MM, ROUND, PLASTIC, BLACK, CONTINUOUS TONE 2.4KHZ, IP40, SOUND PRESS. min. 95 db./10 cm, WITH HOLDER, OPERATING VOLT. 24V AC/DC, SCREW TERMINAL

Brzęczyk kompaktowy 22mm dźwięk ciagły 24 kHz 80dB 24V AC-DC IP40 tworzywo z uchwytem przył śrub SIRIUS ACT 3SU1200-6KB10-1AA0 – SIEMENS | TIM SA

Siemens 3SU1550-1AA10-1FA0 HOLDER FOR 3 MODULES, METAL, 1 NO+1 NC, SCREW TERMINAL | Kempston Controls

SIEMENS indicator light 3SU1200-6KB10-1AA0 - Buy 3SU1200-6KB10-1AA0, SIEMENS indicator light, indicator light 3SU1200-6KB10-1AA0 Product on Shenzhen Juson Automation Company Limited

SIEMENS indicator light 3SU1200-6KB10-1AA0 - Buy 3SU1200-6KB10-1AA0, SIEMENS indicator light, indicator light 3SU1200-6KB10-1AA0 Product on Shenzhen Juson Automation Company Limited

3SU1200-6KB10-1AA0 Acoustic Signal Device | 3SU1200-6KB10-1AA0 Siemens In Stock - Santa Clara Systems

Brzęczyk kompaktowy 22mm dźwięk ciagły 24 kHz 80dB 24V AC-DC IP40 tworzywo z uchwytem przył śrub SIRIUS ACT 3SU1200-6KB10-1AA0 – SIEMENS | TIM SA