Processeur de S7-1200 SIMTransit tout neuf d'origine 1215C 6ES7215-1AG40- 0XB0 1BG40 1HG40 6ES72151AG400XB0 6ES72151BG400XB0 6ES72151HG400XB0 - AliExpress

Processeur de S7-1200 SIMTransit tout neuf d'origine 1215C 6ES7215-1AG40- 0XB0 1BG40 1HG40 6ES72151AG400XB0 6ES72151BG400XB0 6ES72151HG400XB0 - AliExpress

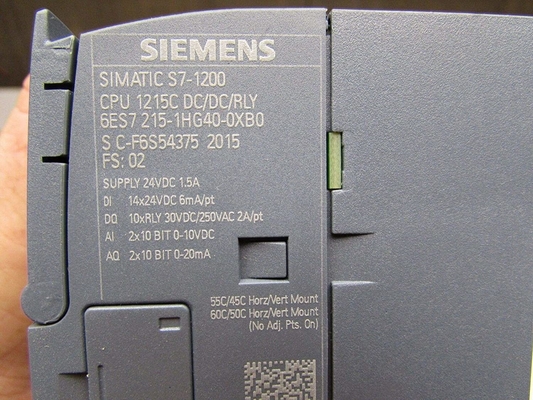

Компактное цпу Siemens SIMATIC S7-1200, 6ES7215-1HG40-0XB0 6ES72151HG400XB0 - выгодная цена, отзывы, характеристики, фото - купить в Москве и РФ

S7-1200, CPU1215C, 6ES7215-1AG40-0XB0, 6ES7215-1BG40-0XB0, 6ES7215-1HG40- 0XB0, CPU1217C, 6ES7217-1AG40-0XB0, Nouveau

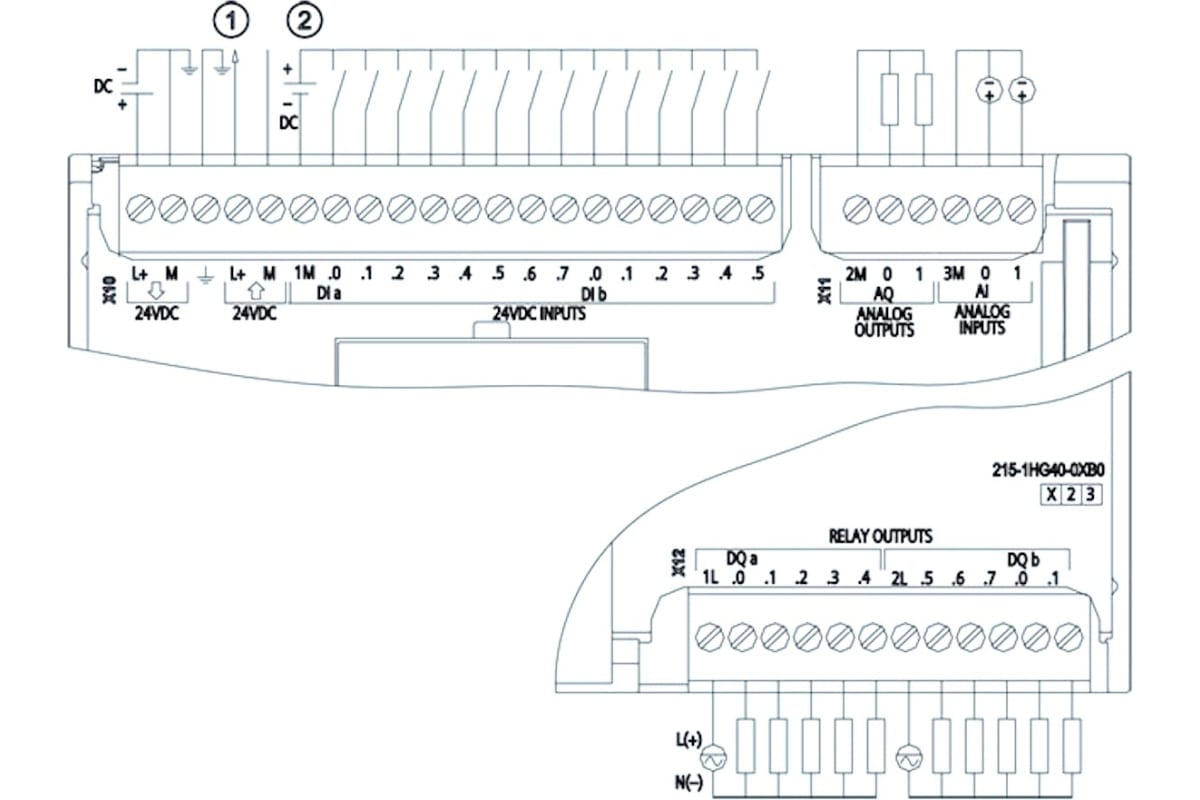

6ES7214-1HG40-0XB0 | Unité centrale Siemens, série SIMATIC S7-1200, 14 (numérique, 2 commutateurs comme analogique) entrées , 10 (sorties | RS

Jual Siemens Simatic 6ES7 215 / 6ES7215-1HG40-0XB0 S7-1200 CPU-1215C - Kota Surabaya - Nazila Electric Indonesia | Tokopedia

6ES7215-1HG40-0XB0 | Unité centrale Siemens, série SIMATIC S7-1200, 14 (numérique, 2 commutateurs comme analogique) entrées , 10 (sorties | RS

SIMATIC S7-1200 Центральный процессор - 6ES7 215-1HG40-0XB0 =24 В, 14 DI =24В, 10 DO (реле) до 2А, 2 AI 0…10 B/10 бит, 2 AO 0…20 ma

6ES7215-1HG40-0XB0 | Unité centrale Siemens, série SIMATIC S7-1200, 14 (numérique, 2 commutateurs comme analogique) entrées , 10 (sorties | RS

6ES7215-1HG40-0XB0 | Unité centrale Siemens, série SIMATIC S7-1200, 14 (numérique, 2 commutateurs comme analogique) entrées , 10 (sorties | RS

NEW SIEMENS 6ES7215-1HG40-0XB0 6ES7 215-1HG40-0XB0 SIMATIC S7-1200 CPU 1215C EUR 330,00 - PicClick FR

PLC COMPACT 6ES7 214 6ES72 occupation 1HG40-0XB0 6ES72141HG400XB0 CPU de S7-1200 de SIMTransit tout neuf et original 1214C - AliExpress