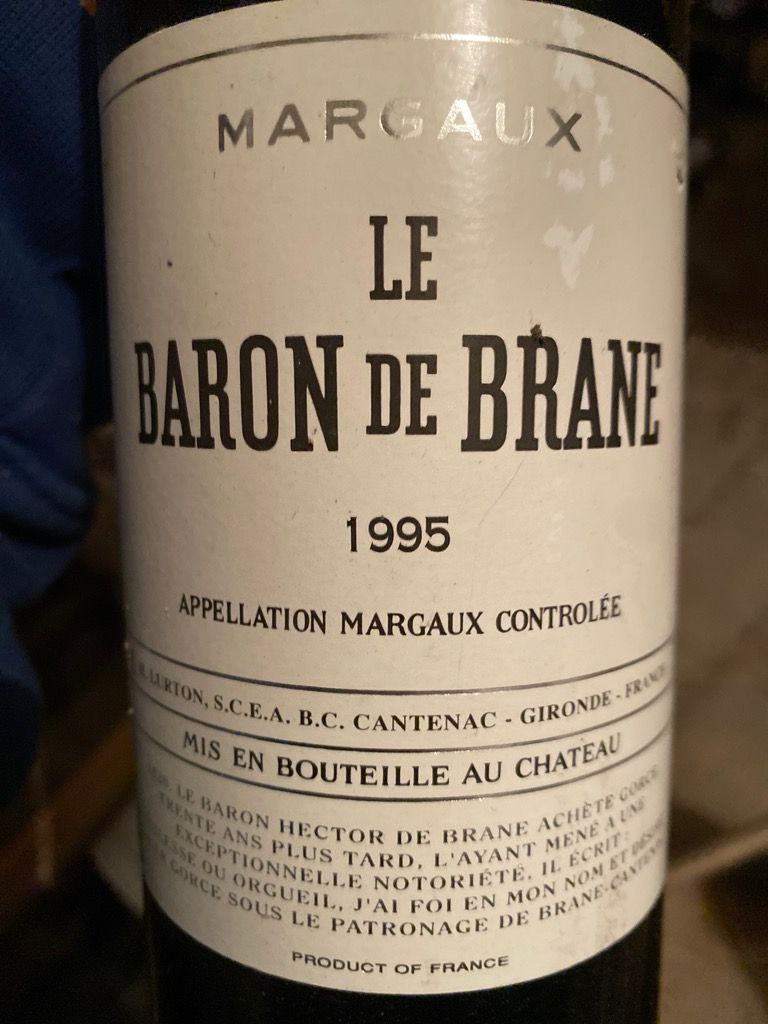

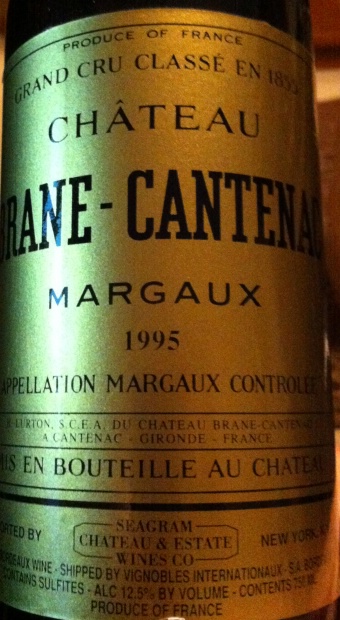

Vins fins et Spiritueux | Vente n°2777 | Lot n°73 12 bouteilles CHÂTEAU BRANE CANTENAC 1995 2e GC Margaux (étiquettes légèrement fanées) | Artcurial

Brane cantenac 1993 (Margaux, vin rouge), vins et champagnes aux meilleurs prix, achetez vos grands crus et champagnes - Millesimes.com

Vins fins et Spiritueux | Vente n°2889 | Lot n°6 10 bouteilles 1 bt : CHÂTEAU BRANE CANTENAC 1995 2è GC Margaux (étiquette sale) | Artcurial

CHÂTEAU BRANE CANTENAC 2016- 2ème Grand Cru Classé - Margaux 98/100 3 Bouteilles EUR 270,00 - PicClick FR