![Tondeuse à Gazon électrique EM 1130, Moteur Turbo Power de 1100 W, Largeur de Coupe 30 cm, réglable en Hauteur sur 3 postions [297] - Cdiscount Jardin Tondeuse à Gazon électrique EM 1130, Moteur Turbo Power de 1100 W, Largeur de Coupe 30 cm, réglable en Hauteur sur 3 postions [297] - Cdiscount Jardin](https://www.cdiscount.com/pdt2/3/3/0/1/700x700/auc3775235031330/rw/tondeuse-a-gazon-electrique-em-1130-moteur-turbo.jpg)

Tondeuse à Gazon électrique EM 1130, Moteur Turbo Power de 1100 W, Largeur de Coupe 30 cm, réglable en Hauteur sur 3 postions [297] - Cdiscount Jardin

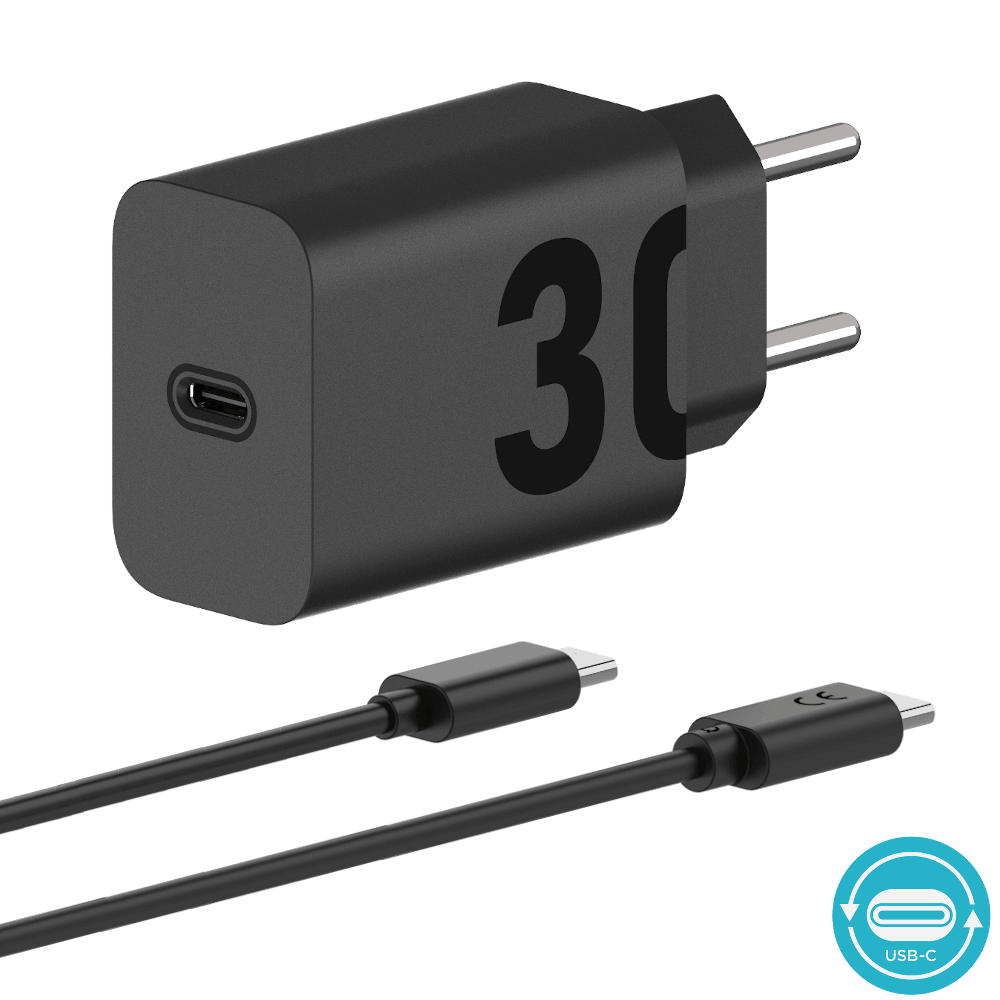

Amazon.com: Motorola TurboPower 30 USB-C Charger with 1m USB-C to USB-C Cable for Motorola Edge (2021/2022), Edge 5G UW, Edge+ (2022/2023), Edge Plus 5G UW (2022), Razr+ (2023), ThinkPhone by Motorola :

Amazon.com: Motorola TurboPower 30 USB-C / Type C Fast Charger - SPN5912A (Retail Packaging) for Moto Z Force : Cell Phones & Accessories

Motorola Original - Pack de 2 à 30 W TurboPower Charger Mural/Adaptateur d'alimentation avec câble USB-C à C dans l'emballage d'origine. : Amazon.fr: High-Tech

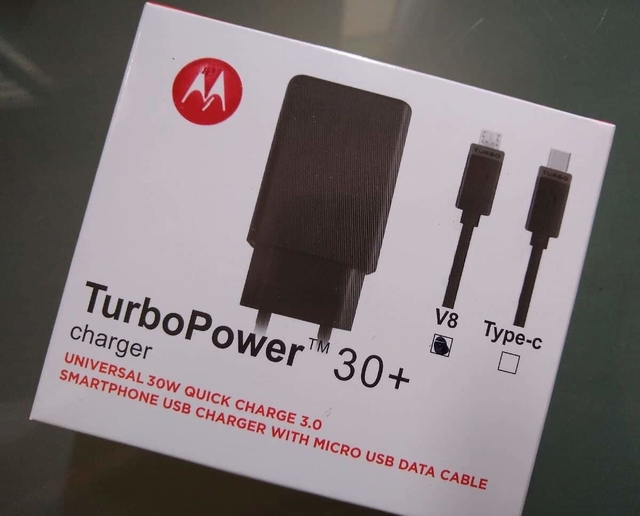

![Brand New] Motorola TurboPower 30 USB-C Type C Fast Charger | eBay Brand New] Motorola TurboPower 30 USB-C Type C Fast Charger | eBay](https://i.ebayimg.com/images/g/E9gAAOSwztNksCxM/s-l1200.webp)