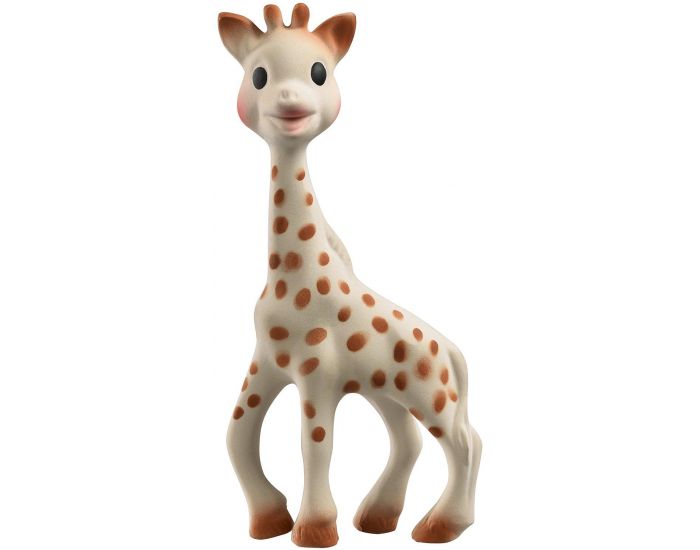

Sophie la Girafe - Fresh Touch Boîte - Jouet en caoutchouc 100% naturel pour enfant - Jouet d'éveil pour enfant - dès la naissance : Amazon.fr: Bébé et Puériculture

Doudou Bio Anneau Jouet 'Caoutchouc Doux' Sophie la Girafe® So'Pure - Ekobutiks® l ma boutique écologique | Jouets Vulli®

Doudou Bio Anneau Jouet 'Caoutchouc Doux' Sophie la Girafe® So'Pure - Ekobutiks® l ma boutique écologique | Jouets Vulli®

Sophie la Girafe - Fresh Touch Boîte - Jouet en caoutchouc 100% naturel pour enfant - Jouet d'éveil pour enfant - dès la naissance : Amazon.fr: Bébé et Puériculture

![SophieLaGirafe] Les cosmétiques bio pour bébés Sophie La Girafe! - ChokoMag SophieLaGirafe] Les cosmétiques bio pour bébés Sophie La Girafe! - ChokoMag](https://chokomag.com/wp-content/uploads/2016/11/IMG_7969.jpg)