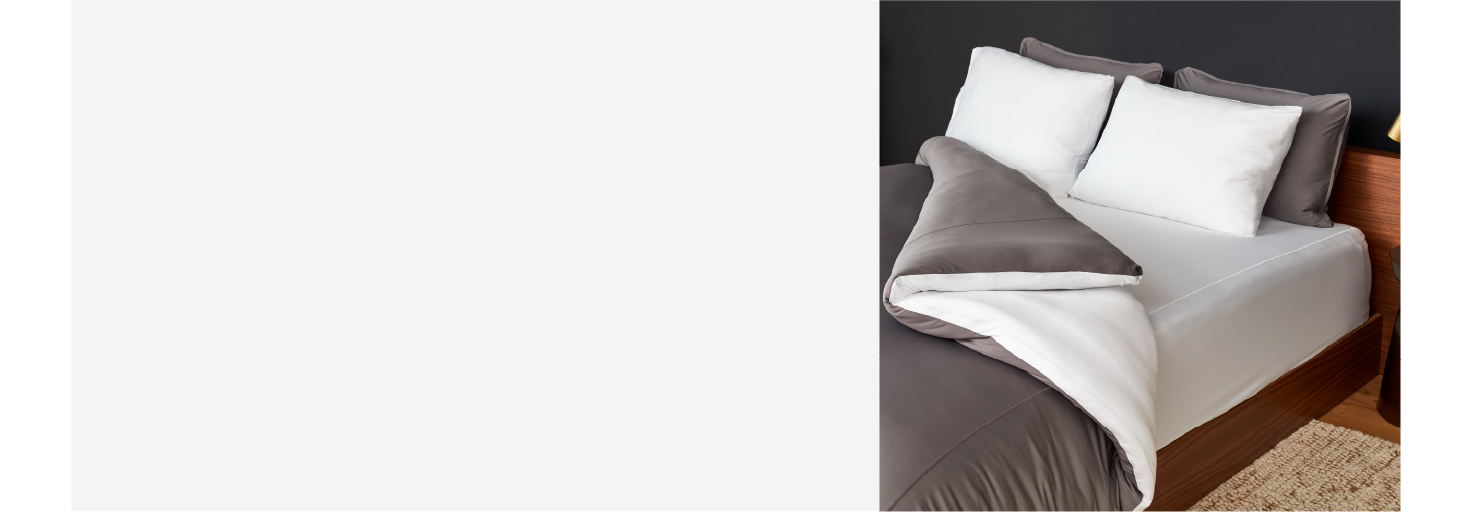

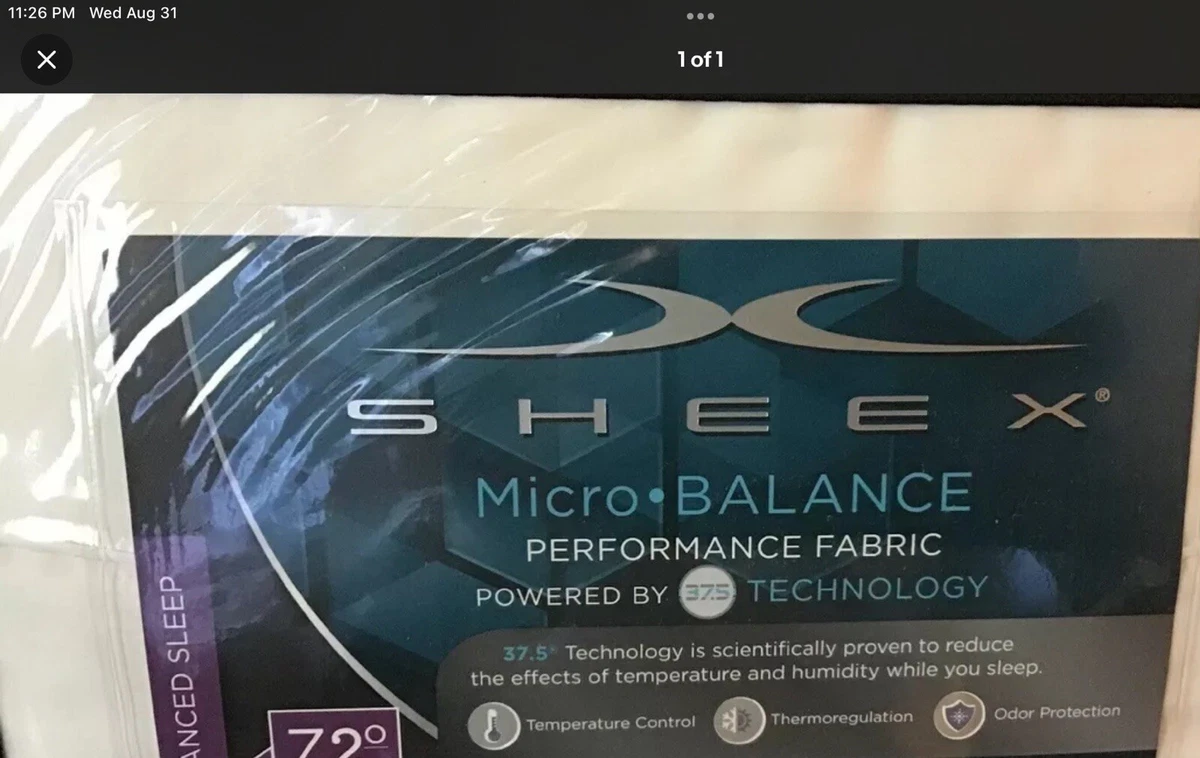

SHEEX - Original Performance Sheet Set with 2 Pillowcases Ulta-Soft Fabric Transfers Heat and Breathes Better Than Traditional - Cdiscount Instruments de musique

SHEEX - Original Performance Parure de lit avec 2 taies d'oreiller, tissu ultra doux rafraîchissant et respirant mieux que le coton traditionnel – Bleu perle, grand lit : Amazon.fr: Cuisine et Maison

Amazon.com: SHEEX Active Comfort Sheet Set, Ultra-Soft Performance Fabric, Breathes Better Than Cotton, Parchment, Queen : Home & Kitchen

Amazon.com: SHEEX Original Performance Down-Alternative Side Sleeper Pillow, Cooling Pillow with Support, Standard/Queen : Sports & Outdoors

Amazon.com: SHEEX Original Performance Sheet Set with 2 Pillowcases, Ultra-Soft Fabric Cooling and Breathes Better Than Traditional Cotton, Graphite, Queen : Home & Kitchen