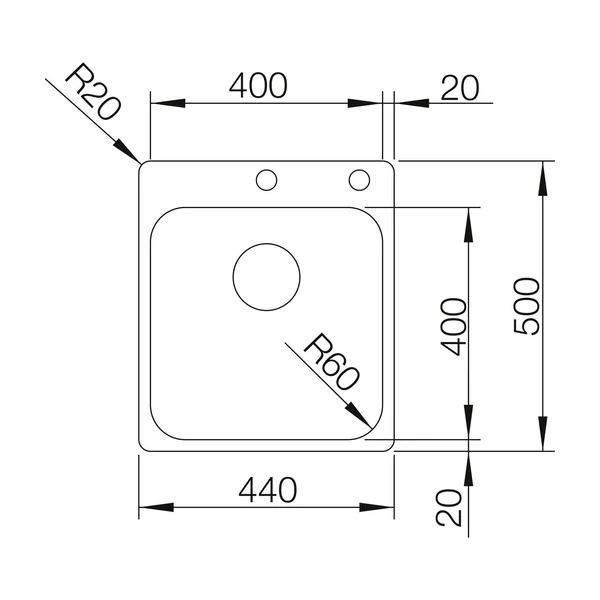

Evier inox 2 Bacs A Fleur de plan blanco Blancoclaron - BLANCOCLARON 400/400 -IF/A - meilleur prix - 514206 - Home Inox

Мийка кухонна Blanco Supra 400-IF/A в стільницю з нержавіючої сталі (ID#684013457), цена: 9020 ₴, купить на Prom.ua

Evier inox 2 Bacs A Fleur de plan blanco Blancoclaron - BLANCOCLARON 400/400 -IF/A - meilleur prix - 514206 - Home Inox

-17919-p.jpg?v=9dd65634-8002-46fa-b7ab-5eda53c4b445)