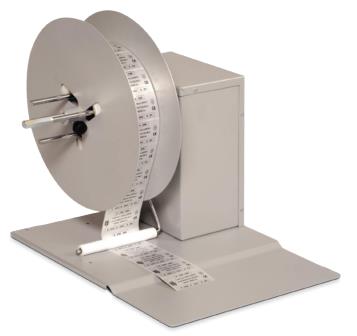

Accessoires pour Réenrouleurs d'étiquettes \ Refendeurs \ Distributeurs \ applicateur GENERIQUE RELA3-Zebra

Термопринтер Zebra ZT230; 4'', 300dpi, Serial, USB, Ethernet (ZT23043- D0E200FZ) купить в Москве: цена, доставка, наличие

Zebra ZT230, 12 Punkte/mm (300dpi), Display, ZPLII, USB, RS232, Ethernet, ZT23043-D0E200FZ günstig beim Experten kaufen | Bauer PK

ACVENTIS Shop | ZEBRA ZT230, 12 Punkte/mm (300dpi), Display, ZPLII, USB, RS232, Ethernet | ZT23043-D0E200FZ | ACVENTIS Catalog

Accessoires pour Pièces détachées imprimantes ZEBRA ZEBRA Rouleau d'entrainement étiquette ZT220 ZT230

Купить Zebra ZT230 ZT23043-D0E200FZ с гарантией и доставкой по Москве. Узнать характеристики в каталоге интернет магазина «Элайтс».

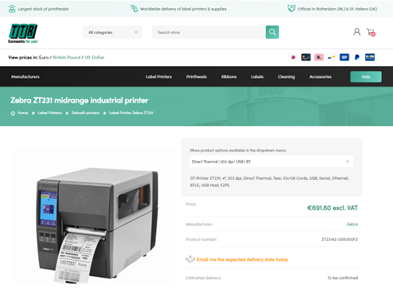

ZT23043-D0E200FZ Zebra ZT230. Print technology: Direct thermal, Maximum resolution: 300 x 300 DPI, Print speed: 152 mm/sec. Conn