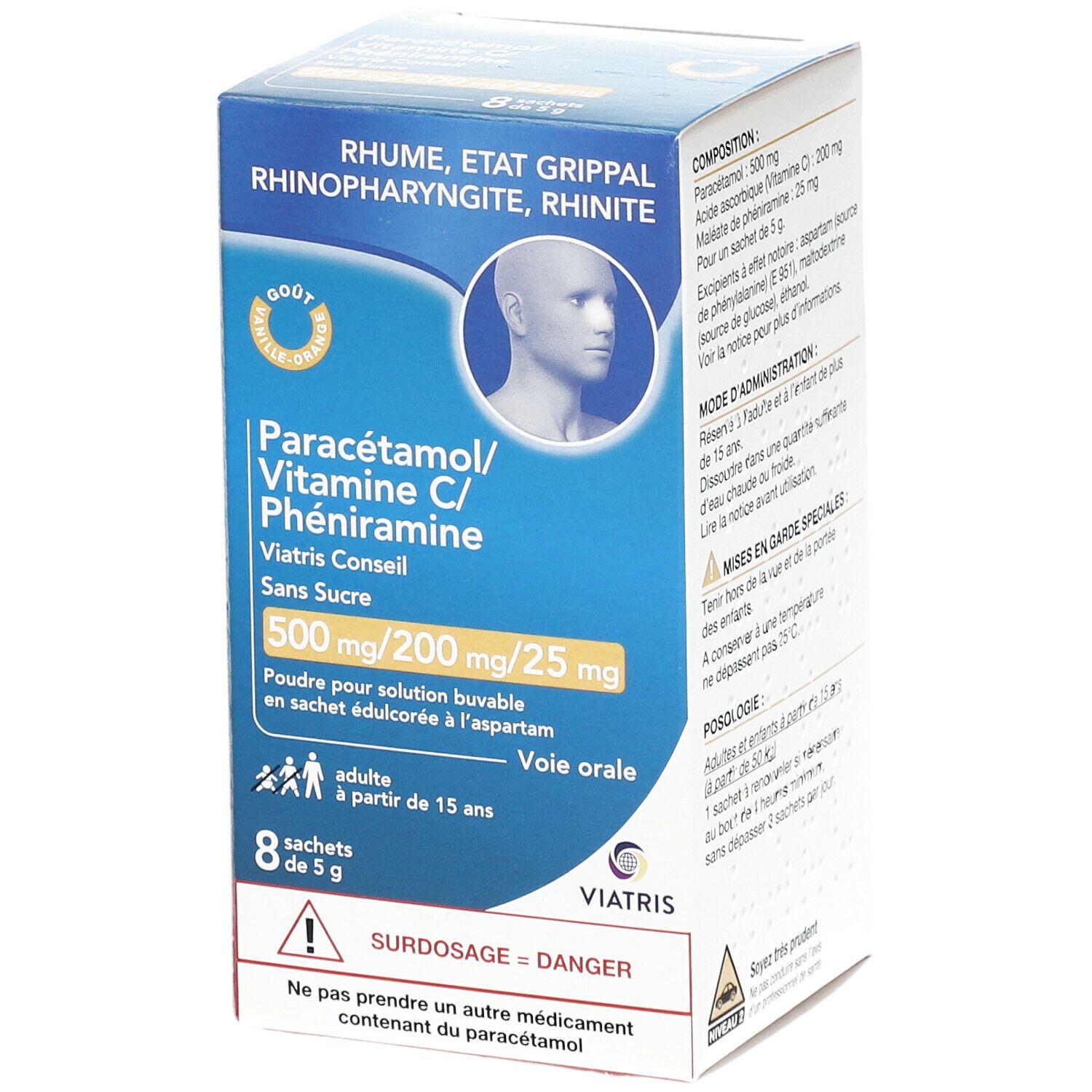

FERVEX ETAT GRIPPAL PARACETAMOL/VITAMINE C/PHENIRAMINE Granulés pour solution buvable en sachet adulte (Boîte de

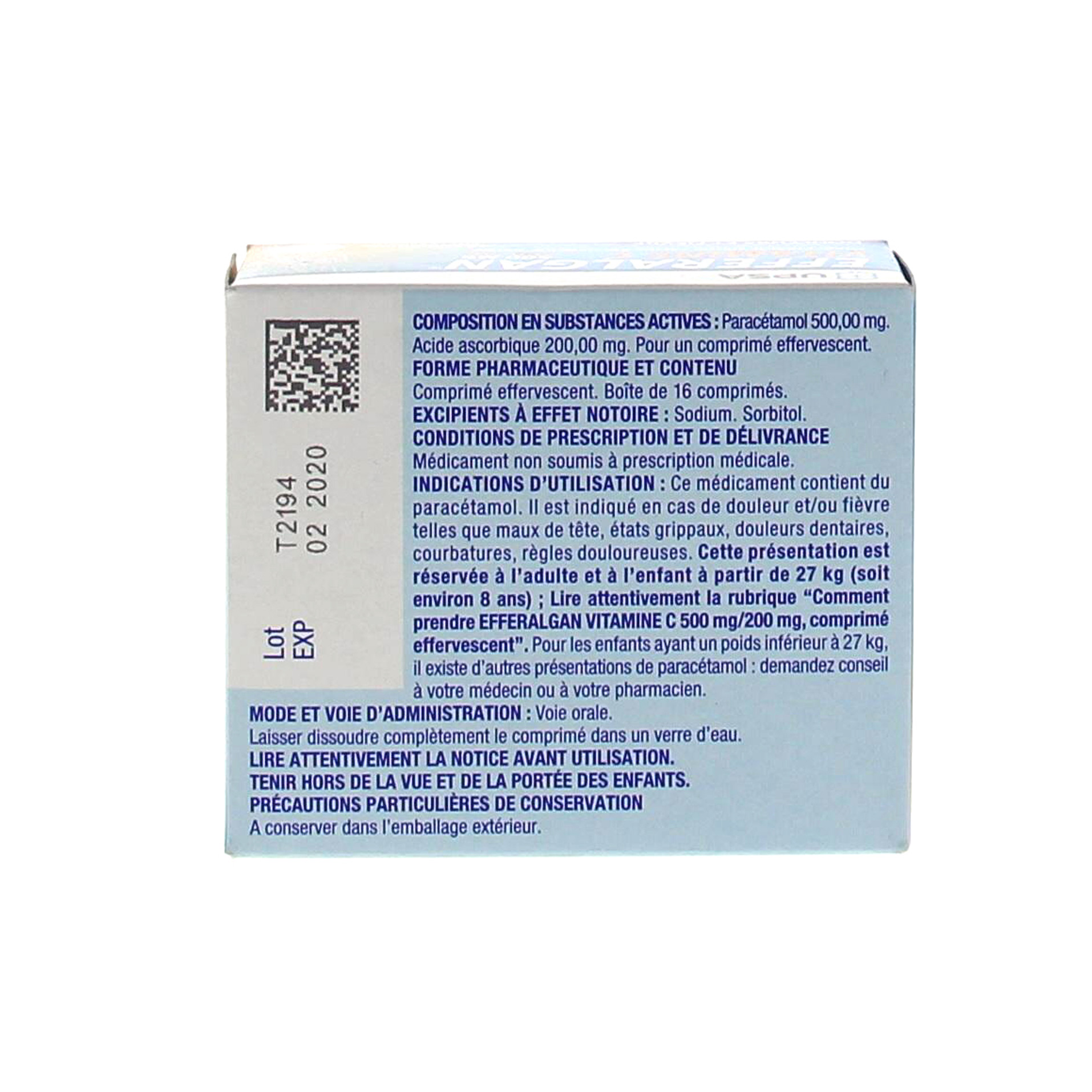

Doliprane vitamine C efferevescent 500mg paracétamol / 150mg vitamine C 16 comprimés - Médicament conseil - Pharmacie Prado Mermoz

FERVEX RHUME PARACETAMOL/VITAMINE C/PHENIRAMINE Granulés pour solution buvable en sachet sans sucre enfant (8