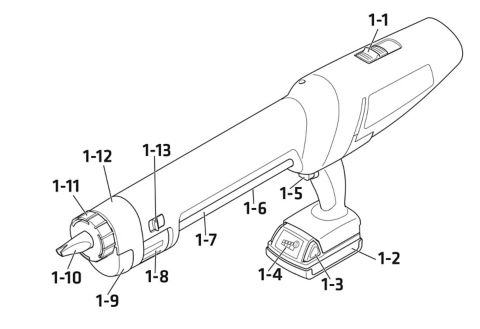

PowerCure Mixer Adapt.HV | Colle Sika pour camping-car, Sikaflex pour camping-car | Accessoires camping-car | Accessoires Camping-car | Reimo Français

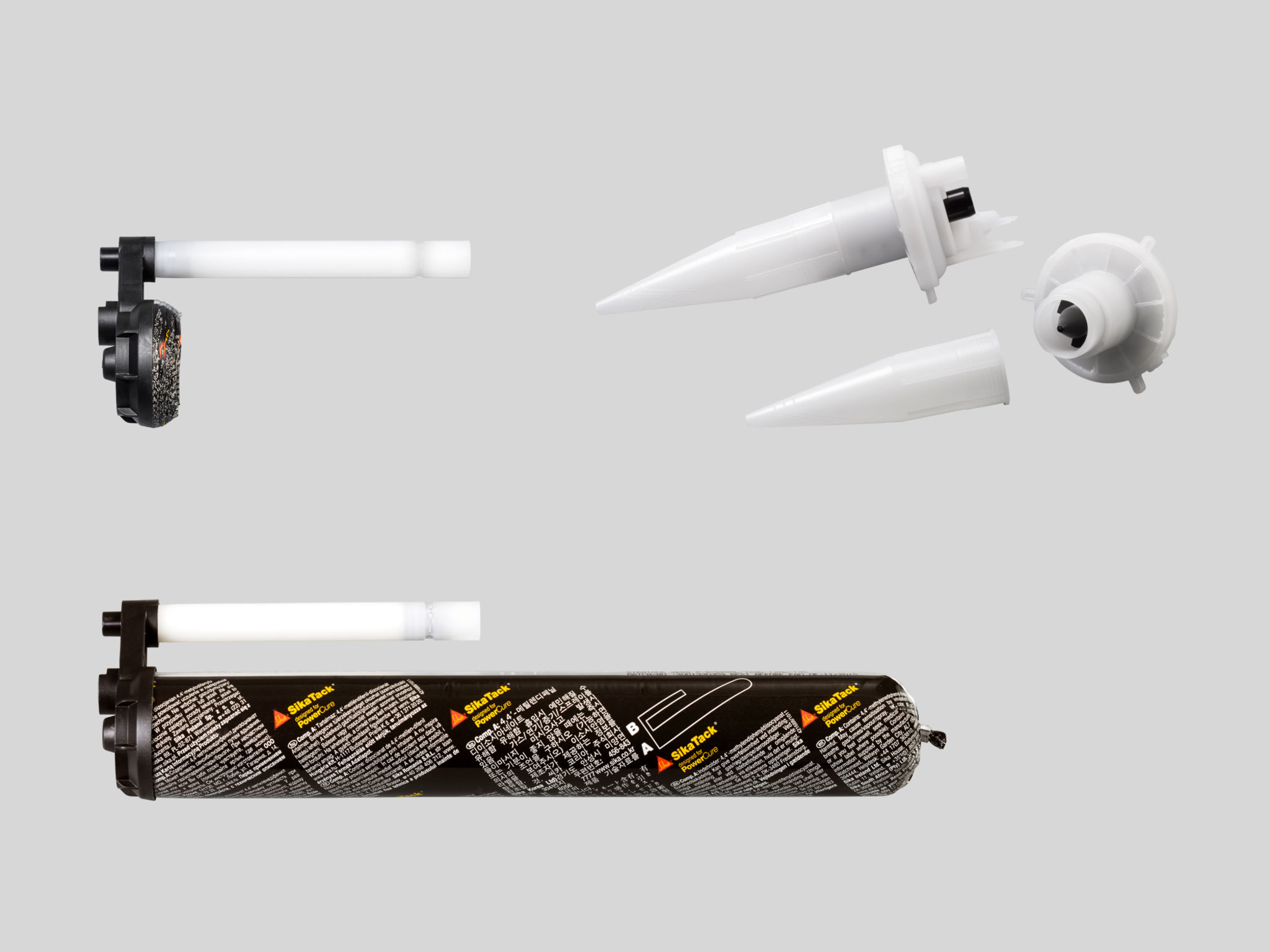

Sikaflex 268 PowerCure Colle-mastic d'étanchéité spécial noir 600ml - achat en ligne | Euro Industry