LENOVO TP T16 G1 R5P 6650U 16p 16/512Go LENOVO ThinkPad T16 Gen 1 AMD Ryzen 5 PRO 6650U 16p WUXGA 16Go 512Go SSD UMA W10P/W11P 3YR P - Cdiscount Informatique

Pc Portable LENOVO TP E14 *20TA002CFR* Lenovo ThinkPad E14 Gen 2 - 14" - Core i5 1135G7 - 8 Go RAM - 256 Go SSD

LENOVO TP THINKBOOK 15-ITL GEN2 15.6" 1920X1080 PIXEL INTEL CORE I5-1135G7 16GB DDR4 SO-DIMM 512GB SSD WINDOWS 10 PROFESSIONAL GREY 20VE00FJIX : Amazon.fr: Informatique

LENOVO TP T14 G3 i7-1255U 14p 16/512Go LENOVO ThinkPad T14 Gen 3 Intel Core i7-1255U 14p WUXGA 16Go 512Go SSD UMA W10P/W11P 3YR Prem - Cdiscount Informatique

LENOVO TP T480s i5-8250U 14p 8G 256G(P) ThinkPad T480s i5-8250U 14p 8Go 256Go SSD PCIe Intel UHD 620 Intel 8265 ac camera HD 720p - Cdiscount Informatique

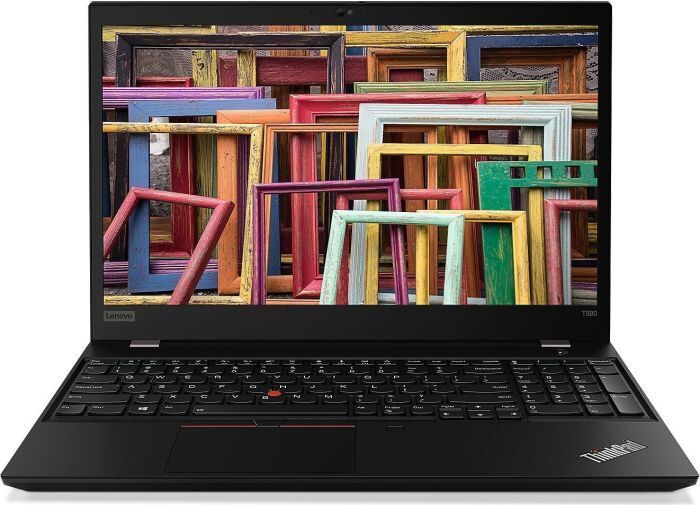

Lenovo ThinkPad T590 | i5-8365U | 15.6" | 8 GB | 512 GB SSD | Win 10 Pro | DE | 472 € | Maintenant avec une période d'essai de 30 jours

Lenovo tp x1 i7-10750h 15p 16go 512go thinkpad x1 extreme g3 intel core i7-10750h 15.6p 16go 512go ssd m.2 pcie nvme gtx 1650ti 4go bt5.x w10p64 3y depot - La Poste

Lenovo ThinkPad T480s | i5-8250U | 14" | 8 GB | 256 GB SSD | Win 11 Pro | DE | 283 € | Maintenant avec une période d'essai de 30 jours

Lenovo ThinkPad T490 | i5-8265U | 14" | 8 GB | 128 GB SSD | FHD | Rétroéclairage du clavier | 4G | Win 10 Pro | SE | 342 € | Maintenant avec une période d'essai de 30 jours

BLACK-FRIDAY 2023 : Lenovo tp p16 g1 i7-12800hx 16p 16/512go thinkpad p16 g1 intel core i7-12800hx 16p wuxga 16go 512go ssd rtx a2000 8go w11p 3yr premier 21D60010FR pas cher

LENOVO TP P16 G1 i7-12850HX 16p 16/512Go LENOVO ThinkPad P16 G1 Intel Core i7-12850HX 16p WQUXGA 16Go 512Go SSD RTX A3000 12Go W11P - Cdiscount Informatique

Lenovo ThinkPad T470s | i7-6600U | 14" | 8 GB | 128 GB SSD | Win 10 Pro | DE | 299 € | Maintenant avec une période d'essai de 30 jours